Buying a House in Japan A Complete Guide

Thinking of buying a house in Japan? This guide covers the property market, buying process for foreigners, and all the hidden costs. Start your journey here.

Posted by

So, you're thinking about buying a house in Japan. It's an exciting prospect, but it’s crucial to understand that the Japanese real estate market plays by a completely different set of rules than what you might be used to in the West.

Think of a new car driving off the lot—it starts losing value immediately. In many ways, Japanese homes are viewed the same way: as depreciating assets. This guide will walk you through this unique market so you can figure out if it's the right fit for you.

Is Buying a House in Japan a Good Idea?

Let's get right to it: Is buying a home in Japan a smart move? There’s no simple "yes" or "no" answer. It really comes down to your personal finances, what you're looking for in a lifestyle, and whether you're comfortable with a market where the fundamental principles of real estate are flipped on their head.

The single most important thing to wrap your head around is this: in Japan, the physical house often loses value over time. It's the land it sits on that holds—or sometimes increases—its worth. This is why it's common to see homes torn down and rebuilt after just 20 or 30 years. It’s a world away from the Western mindset of a house as a long-term, appreciating investment.

If you're an international buyer, this concept is key. We cover this and more in our comprehensive overview on buying a house in Japan as a foreigner. This unique market dynamic really shapes everything, from the types of properties available to the investment strategies that actually work here.

Quick Guide to Japanese Property Types

To get started, it helps to know what your options are. The table below gives you a quick snapshot of the main property types you'll find in Japan. Each offers a very different living experience, so understanding the basics is the first step to finding your perfect fit.

| Property Type | Description | Best For | Typical Price Range |

|---|---|---|---|

| Ikkodate (一戸建て) | A detached, single-family house, often with a small yard or parking. | Families, those seeking privacy and space, suburban/rural living. | Varies widely by location; from ¥15M in rural areas to ¥100M+ in major cities. |

| Manshon (マンション) | A modern apartment or condominium, usually built with reinforced concrete. | Singles, couples, city dwellers who value security and amenities. | ¥20M - ¥80M+ for new builds in urban centers. |

| Akiya (空き家) | A vacant or abandoned home, often sold for very low prices or given away. | DIY enthusiasts, those on a tight budget, people looking for a unique project. | ¥0 - ¥5M, but renovation costs can be substantial. |

This table should give you a solid starting point for thinking about which type of property aligns with your goals and lifestyle. Now, let's take a closer look at a particularly interesting category.

The Rise of Akiya (Vacant Homes)

You may have heard about akiya—the vacant homes that have been making headlines around the world. These properties are a direct result of Japan’s shifting demographics, particularly its aging population and the trend of younger generations moving to big cities.

The scale of the issue is massive. A recent government survey found a record-high 9 million vacant homes, which means the national vacancy rate is now 13.8%. Of those, around 3.85 million are completely abandoned, not even on the market for sale or rent.

For many, an akiya seems like the ultimate bargain—a dirt-cheap way to own property in Japan. But be careful. These homes often come with a long list of hidden costs for major repairs, ongoing taxes, and maintenance that can turn a "free" house into a very expensive project.

So, is buying a house in Japan a good idea? It all comes back to your why. If you're dreaming of a place to settle down long-term, embrace a different lifestyle, or take on a rewarding passion project, it can be an incredible experience. But if you're just looking for a quick financial flip, the market's depreciation model makes it a much tougher, and riskier, game to play.

Getting a Feel for the Current Real Estate Market

Before you can really start your property search in Japan, it’s crucial to understand the unique rhythm of its real estate market. It doesn't behave like the often volatile, appreciation-obsessed markets you might see in the West. Japan’s market is far more nuanced, driven by a very different set of economic and demographic forces. Getting your head around these trends is the first step toward making a really smart investment.

On the surface, things look good. The Japanese real estate market is showing signs of steady, confident growth, recently valued at an impressive USD 436 billion. Projections show it climbing to USD 557 billion within the next decade, thanks to a mix of strong international investment and a resilient domestic economy. It’s a stable environment for buyers.

But stability doesn't mean prices are flat. When you dig a little deeper, you’ll find some fascinating trends depending on what and where you’re buying.

Land Value vs. Building Value: The Core Concept

Here’s one of the most important things to understand about buying property in Japan: the value of the land is separate from the value of the building. In most cases, the physical house itself is treated like a depreciating asset, a lot like a new car that loses value the moment you drive it off the lot.

It’s the land underneath the house that typically holds or increases in value.

This simple fact completely changes how you should approach a purchase. An older house on a prime piece of land in a good neighborhood could be a much better long-term investment than a brand-new build in a less desirable area. The land is your real asset here.

This is why you'll often see perfectly good 30-year-old homes being torn down to make way for a new one. The owner knows the land's value justifies a fresh start. For buyers used to Western markets where older homes gain character and value, this can be a real shock.

When you look at a property, you’re really making two separate evaluations: one for the land, and another for the structure sitting on it.

Price Trends: A Tale of Two Japans

As you'd probably guess, there’s a massive price difference between Japan’s buzzing cities and its quieter, more rural prefectures. Places like Tokyo, Osaka, and Fukuoka have seen property prices climb steadily, and it's not hard to see why.

- Tourism is Back: The return of international tourists has fired up the demand for hotels and short-term rentals, which naturally pulls up residential prices in popular urban areas.

- Construction Costs are Up: The rising cost of building materials and labor means new condos and houses are more expensive to build, especially in high-demand city centers.

- People are Moving to the Cities: Young professionals continue to flock to major urban hubs for jobs, keeping the demand for apartments and compact homes consistently high.

Head out to the countryside, and you'll find a completely different story. While land prices are inching up modestly across the country, many smaller towns are dealing with depopulation. This has created a market flush with affordable properties, including the akiya (vacant homes) that get so much attention. For a more detailed look, check out our guide on Japan housing prices, which really gets into these regional differences.

This split between urban and rural Japan creates distinct opportunities. If you're chasing high rental income and hoping for your property's value to grow, the city is where you should be looking. But if a relaxed lifestyle and getting more for your money are your top priorities, the countryside offers incredible value. The key is to align your personal goals with these market realities.

Your Step-By-Step Home Buying Process

Buying a house in Japan can feel a little intimidating from the outside, but the process itself is surprisingly logical and well-defined. Think of it less as a maze and more as a clear roadmap. Once you understand the key stages, you can navigate the journey with confidence.

It's a bit like assembling a high-quality piece of furniture. You wouldn't just start screwing pieces together randomly; you'd lay everything out, follow the instructions, and build from the ground up. This methodical approach ensures a solid, successful outcome, and the same is true for buying property here.

Phase 1: Finding Your Team and Property

This initial phase is all about laying the groundwork. It's where you get your finances in order, find the right professional guide, and start the exciting hunt for your perfect home.

-

Financial Planning and Pre-Approval: Before you even look at a single listing, the first stop is figuring out your budget. If you're planning on a mortgage, talk to a bank to get pre-approved. This is crucial because it tells you exactly what you can afford and, just as importantly, signals to sellers that you're a serious, credible buyer.

-

Find a Real Estate Agent: Your agent will be your most important partner in this process, especially if you're a foreign buyer. A good one does more than just find listings; they're your guide to local market quirks, your navigator through the paperwork, and your advocate during negotiations.

-

Property Search and Viewings: Now for the fun part. With your agent on board and your budget set, you can start searching for your ideal house in Japan. Getting out there for viewings, known as naiken (内見), is essential. It’s the only way to truly get a feel for a home, the light, the neighborhood, and whether it clicks with you.

Phase 2: Making It Official

You've found "the one." Now it’s time to shift from browsing to buying. This stage is all about formal offers, legal checks, and a whole lot of important paperwork.

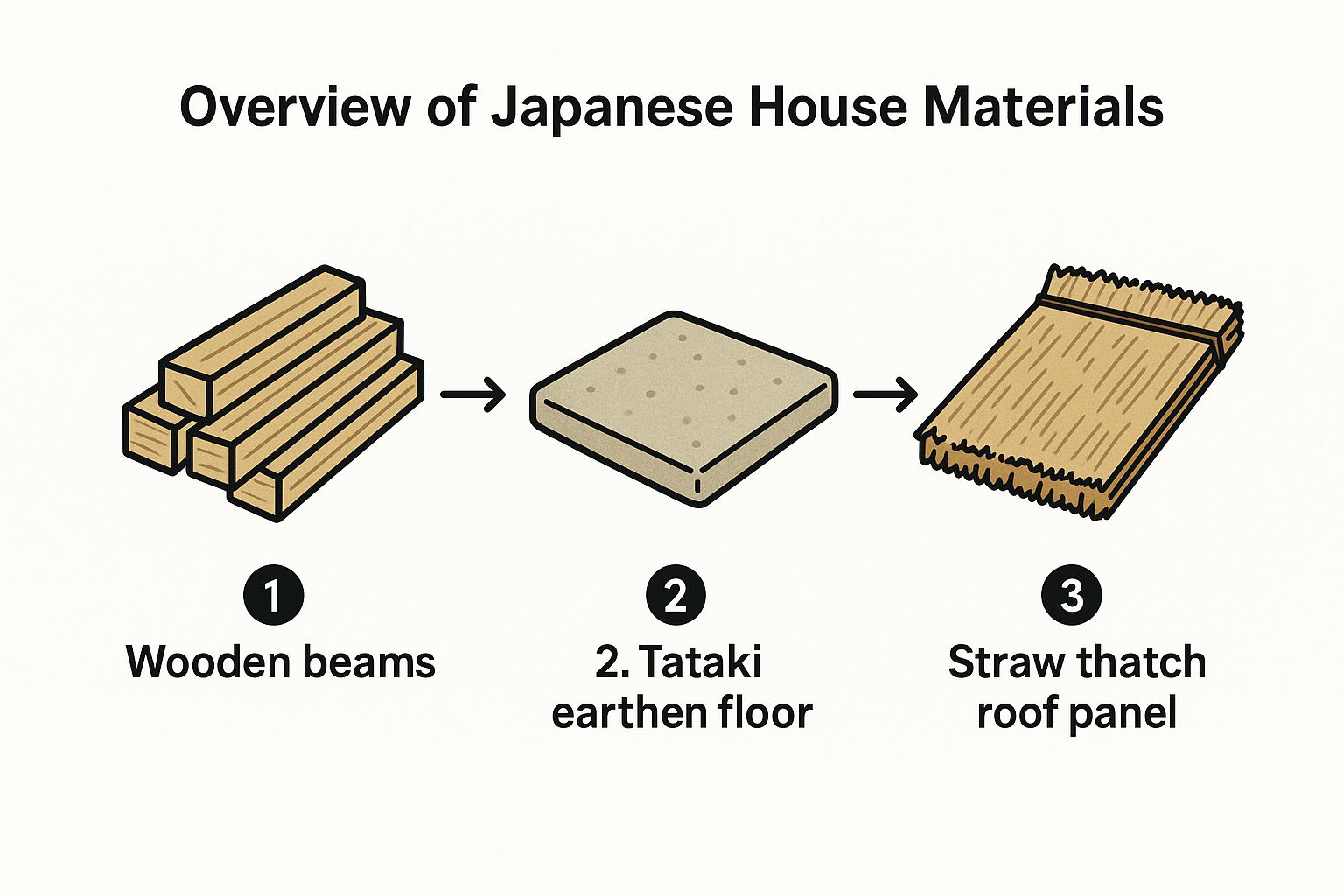

The infographic below gives you a feel for the traditional elements and materials you might encounter, especially in older homes. Understanding this heritage can give you a much deeper appreciation for the property you're about to purchase.

First up, you'll submit a Letter of Intent or Purchase Application, called a kaitsuke shomeisho (買付証明書). This isn't legally binding, but it's your formal way of saying, "I want to buy this house at this price under these conditions." If the seller accepts, you move on to the serious due diligence.

Next comes what is arguably the most critical step in the entire process: the Explanation of Important Matters, or juyou jikou setsumei (重要事項説明). A licensed real estate professional will sit down with you and go through a dense, detailed document covering everything from zoning restrictions and boundary lines to any known issues with the property.

This is your moment. It’s the legally mandated time to ask every question you can think of and make sure there are no hidden surprises. In Japan, this must happen before you sign the final contract, a fantastic piece of consumer protection for buyers.

Once you’re satisfied, you’ll sign the formal Purchase and Sale Agreement. This is when you'll pay the deposit, which typically runs 5-10% of the sale price. Be aware that this deposit is usually non-refundable if you pull out of the deal for a reason not covered in the contract.

Phase 3: Closing the Deal

This is the home stretch, where the keys are almost in your hand. The final phase involves finalizing your loan, completing the legal transfer, and officially taking ownership.

You’ll work with your bank to finalize the mortgage and get the funds ready for transfer. Then, you, the seller, your agent, and a key legal expert called a judicial scrivener (shiho shoshi, 司法書士) will meet for the final settlement.

The judicial scrivener is a government-licensed professional who plays a massive role in the final step. Their job is to:

- Verify everyone’s identity.

- Check that all the documents are in perfect order.

- Register the change of ownership with the Legal Affairs Bureau.

- Ensure the seller’s existing mortgage is paid off, giving you a clean title.

Once the scrivener confirms everything is correct and the final payment has been made, they will file the paperwork. And just like that, the property is officially yours. Congratulations, you’ve just bought a house in Japan

Breaking Down the True Costs of Ownership

When you're looking at property listings, that big number—the sales price—is just the beginning. It's not the final figure you'll need to have ready. A common oversight, especially for first-time buyers, is forgetting to account for all the extra fees that come with the territory.

These one-time and recurring costs are a standard part of buying property here, and they can easily add an extra 6% to 8% on top of the home's price. Think of it this way: the list price gets you the house, but the extra fees are what actually make it yours in the eyes of the law and the local government. Budgeting for them upfront is the key to a stress-free purchase.

One-Time Acquisition Costs

As you get closer to finalizing the sale, a series of one-time fees will pop up. These are the setup costs of homeownership, covering everything from professional services to mandatory government taxes.

Here’s a look at what you can expect to pay to get the keys in your hand:

- Agent's Commission (仲介手数料, Chukai Tesuryo): This is what you pay your real estate agent for their hard work. It’s typically calculated as 3% of the property price + ¥60,000, plus consumption tax.

- Stamp Duty (印紙税, Inshi-zei): A tax paid on the official sales contract itself. The amount depends on the property's price, usually ranging from a few thousand to tens of thousands of yen.

- Registration and License Tax (登録免許税, Toroku Menkyo Zei): This is a tax for legally registering the change of ownership and putting the property title in your name. A judicial scrivener handles this, and the fee is based on the property’s official assessed value.

- Property Acquisition Tax (不動産取得税, Fudosan Shutoku Zei): Don't be surprised when another tax bill shows up a few months after you move in. This is a one-time local tax on acquiring real estate, and it’s also based on the assessed value, not what you actually paid.

A Quick Note on Valuations: You'll notice many taxes are based on the government's official "assessed value," not the market price. This value is almost always lower than what you paid for the property, which often means your tax bill will be a bit less than you might have guessed.

To make this more concrete, let's walk through a sample budget.

Budgeting for a ¥50 Million Property Purchase

This table breaks down the typical one-time fees and taxes you'll face when buying a mid-range home in Japan.

| Cost Item | Estimated Percentage or Amount | What It Covers |

|---|---|---|

| Agent's Commission | ¥1,716,000 (3% + ¥60k + tax) | Your real estate agent's service fee for managing the transaction. |

| Stamp Duty | ¥30,000 | Tax on the official purchase and sale agreement. |

| Registration Tax | ~¥600,000 (~1.2% of assessed value) | Fee to legally register your ownership of the property and land. |

| Judicial Scrivener Fee | ~¥100,000 | Professional fee for the legal expert who handles the registration. |

| Property Acquisition Tax | ~¥525,000 (~1.05% of assessed value) | A one-time local tax on buying property, billed post-purchase. |

| Misc. & Contingency | ~¥100,000 | Small fees like fire insurance premiums and a buffer for surprises. |

| Total Estimated Fees | ~¥3,071,000 | This is your approximate "out-of-pocket" cost on top of the price. |

As you can see, the extra costs are substantial. Factoring them into your budget from day one is absolutely essential to avoid any last-minute financial scrambling.

Ongoing Annual Taxes

Once the purchase is complete and you're settled in, your financial obligations shift from one-off fees to recurring annual taxes. These are the ongoing costs of owning a piece of Japan, and they help fund local services like schools, road maintenance, and garbage collection.

There are two main taxes every homeowner pays each year for their house in Japan:

- Fixed Asset Tax (固定資産税, Kotei Shisan Zei): This is the main property tax, paid by every property owner to their local municipality. It’s calculated as 1.4% of the property’s assessed value.

- City Planning Tax (都市計画税, Toshi Keikaku Zei): This tax only applies if your home is in a designated "city planning zone" (most urban and suburban areas are). It funds local development projects and is set at 0.3% of the assessed value.

Your local municipal office will send you a single bill for both taxes once a year. While the percentages might not sound like much, they add up to a significant and permanent part of your annual budget. By planning for both the upfront costs and these long-term taxes, you’ll have a clear and realistic picture of what homeownership truly costs.

A Closer Look at the Tokyo Property Market

Tokyo isn't just another Japanese city; it's an economic and cultural behemoth, and its real estate market operates on a completely different level. For anyone looking to buy a house in japan, understanding Tokyo means getting to grips with a market driven by intense domestic demand, waves of global investment, and a constant cycle of redevelopment.

While many parts of Japan are dealing with a shrinking population, Tokyo is still growing. It’s a magnet for professionals from across the country and around the world, which keeps housing demand consistently high. This makes the environment for buyers incredibly powerful, but also fiercely competitive. It's less a single market and more a patchwork of unique micro-markets, each with its own vibe and price tag.

New Versus Used Apartments: A Tale of Volatility

One of the most fascinating dynamics in Tokyo is the push and pull between new and used properties. The market for brand-new condominiums, in particular, can be a real rollercoaster. It's often thrown off by the launch of a few ultra-luxury towers that send the city's average prices through the roof.

We saw this play out recently with some dramatic swings. The average price for a new condo in the greater Tokyo area shot up to a historic high of about 104.85 million yen (around $700,000 USD). That’s a staggering 37.5% jump in just one year. But then, a month later, prices dropped back down to 90 million yen—a 7% fall from the previous year—simply because fewer high-end units happened to sell that month.

At the same time, the market for used condos showed steady, reliable growth. Prices in Tokyo's 23 wards climbed to 44.51 million yen, marking a 28.3% annual increase, which was the highest jump ever recorded. You can explore more about these market fluctuations to get a clearer picture of these trends.

What this tells us is pretty clear: new builds grab the headlines with their spectacular highs and lows, but the used apartment market often offers a more stable and predictable investment. For a lot of buyers, a well-kept, pre-owned apartment simply delivers better value and a less stressful path to ownership.

Navigating Tokyo's Diverse Wards

Tokyo is a mosaic of 23 "special wards," and each one has its own distinct personality. Picking the right one is just as critical as picking the right property. Your lifestyle, budget, and what you value most will ultimately point you to the neighborhood where you’ll feel at home.

Investing in Tokyo means buying into a high-demand, high-stakes environment. While the potential for strong rental returns is significant, buyers must be prepared for steep prices and intense competition, especially in the most sought-after central districts.

To give you a sense of the sheer variety, here’s a quick tour:

- The Central Powerhouses (Minato, Chiyoda, Shibuya): This is Tokyo’s top-tier, blue-chip real estate. These wards are home to multinational corporations, luxury shopping, and buzzing nightlife. They command the highest prices but deliver unparalleled convenience and prestige.

- The Family-Friendly West (Setagaya, Suginami): As you move west from the city center, the vibe becomes much more residential and relaxed. These areas boast more green spaces, larger homes, and a quieter pace of life, making them a huge draw for families.

- The Traditional East (Taito, Sumida): Wards like Taito offer a connection to old Tokyo, or shitamachi. Here you'll find historic temples, traditional artisan shops, and a palpable sense of community. Property is often more affordable, giving you a culturally rich place to live.

In the end, successfully navigating the Tokyo market means you have to look past the city-wide averages. It requires digging into specific wards and neighborhoods, understanding the key differences between new and used properties, and matching your strategy to the energetic, ever-shifting pulse of Japan’s capital.

Common Questions About Buying a House in Japan

Stepping into the Japanese real estate market naturally brings up a lot of questions. It's a journey filled with unique processes and cultural nuances that can seem a bit confusing at first glance, especially if you're coming from abroad.

This section is designed to be your go-to guide for those nagging, practical questions. We'll cut through the noise and give you straight answers on everything from visa rules and loan challenges to the real story behind those cheap vacant houses, or akiya.

Can Foreigners Buy Property Without a Visa?

Let's get the biggest question out of the way first. Yes, absolutely. Foreigners can legally purchase and own property in Japan, regardless of their visa status. You don't need to be a resident, have permanent residency, or hold any specific long-term visa to buy a home. It's entirely possible to complete a purchase while on a tourist visa or even from your home country.

But here’s the crucial catch: owning property does not give you the right to live in Japan. Your ability to stay in the country is tied directly to your visa. If you buy a beautiful house but only have a tourist visa, you're still limited to its restrictions, which is typically a 90-day stay.

This clear line between property rights and residency rights is a fundamental part of Japanese law. While the door to ownership is wide open, actually living in your new home long-term means you’ll need to secure the proper visa through work, family, or other official channels.

How Difficult Is Getting a Home Loan as a Non-Resident?

This is where reality tends to bite. While you have the legal right to buy, getting a mortgage from a Japanese bank as a non-resident without permanent residency (PR) is incredibly tough. For most major Japanese lenders, having PR is the absolute minimum requirement to even consider a home loan application.

Why are they so strict? It all comes down to risk assessment. From a bank's perspective, an applicant without deep, long-term roots in Japan is a higher-risk borrower, making them very cautious about approving a large loan.

So, if you're a non-resident, your financing options usually look like this:

- Cash Purchase: This is the most direct path. Buying the property outright with cash means you don't have to navigate the Japanese mortgage system at all.

- Loan from Your Home Country: It's worth checking with international banks in your home country. Some may offer financing for overseas property purchases, but it will depend heavily on your financial situation and their specific policies.

- Limited Japanese Lenders: A handful of institutions, like Prestia SMBC Trust Bank, are known to work with non-PR holders. However, expect much stricter terms, like requiring a significant down payment or having a very specific type of employment.

What Are the Risks of Buying an Akiya?

The dream of snapping up a super-cheap or even "free" vacant house, known as an akiya, is a powerful one. It can be an amazing entry point into the market, but it's a path filled with unique risks that you need to take seriously. These aren't just simple fixer-uppers.

Many akiya are sold completely "as-is," which can mean anything from a bit of cosmetic work to a money pit of hidden problems. The biggest red flags include:

- Serious Structural Issues: A lot of these older homes were built before modern earthquake-resistance standards were introduced. Bringing them up to code can require incredibly expensive reinforcement work.

- Hidden Renovation Costs: That low price tag is just the beginning. You might uncover rotten floorboards, outdated wiring, a leaky roof, or serious pest infestations. These repairs can easily run into millions of yen.

- Ownership Complications: Things can get messy if the owner passed away without a clear will. The ownership might be split between several heirs who are scattered and hard to find, making the sale process a legal and logistical nightmare.

Before you fall in love with a charming old house, you have to do your homework. Digging into the key questions to ask before buying a home in Japan will arm you with the knowledge to spot potential disasters.

How Does Inheritance Work for Foreign Owners?

When you own property in Japan as a foreigner, your rights are the same as a Japanese citizen's—the property becomes part of your estate. The inheritance process itself, however, can get complicated because it often involves multiple legal systems. Typically, the laws of the deceased owner's home country will dictate who the rightful heirs are.

For instance, if an American citizen who owns a home in Kyoto passes away, US inheritance law would likely determine the line of succession. But that's not the end of the story. Japan's inheritance tax might still apply to the property. This tax is calculated based on the property's value, and the rates can be steep, climbing as high as 55%.

Given the complexities, it's a very good idea for any foreign owner to talk to a legal expert who specializes in international inheritance. They can help you map out a clear plan, understand the tax implications, and give you—and your heirs—invaluable peace of mind.

Ready to turn your dream of owning a home in Japan into a reality? At mapdomo, we've simplified the search. Our interactive platform allows you to explore thousands of properties across Japan, from modern city apartments to charming countryside akiyas, all on one easy-to-use map. Start your search today and find your perfect place at https://mapdomo.com.