A Guide to Japan Housing Prices for Buyers

Thinking of buying property in Japan? This guide breaks down Japan housing prices, market trends, and regional differences to help you invest wisely.

Posted by

Let's get right to it. The story of Japan's housing market isn't a single narrative—it's a tale of two completely different worlds. In bustling cities like Tokyo and Osaka, property prices are on a steady upward climb, fueled by intense demand and a healthy dose of foreign investment. Step outside these urban hubs, however, and you'll find a different picture entirely: rural areas with stagnant prices and a growing number of vacant homes, known as 'akiya'.

Understanding The Current Japan Housing Market

To really get a feel for Japanese property prices today, you have to wrap your head around this fundamental split. It’s not one unified market. Instead, think of it as a patchwork of micro-markets, many of which are moving in opposite directions. The big cities are high-demand ecosystems where land is a precious commodity and property is a prized asset. Meanwhile, much of rural Japan is grappling with depopulation, which has left a surplus of homes.

This sharp contrast presents both hurdles and fascinating opportunities for anyone looking to buy. A sleek, modern apartment in a desirable Tokyo ward will definitely cost you a premium. But a traditional house out in the countryside? It might be available for just a fraction of that price.

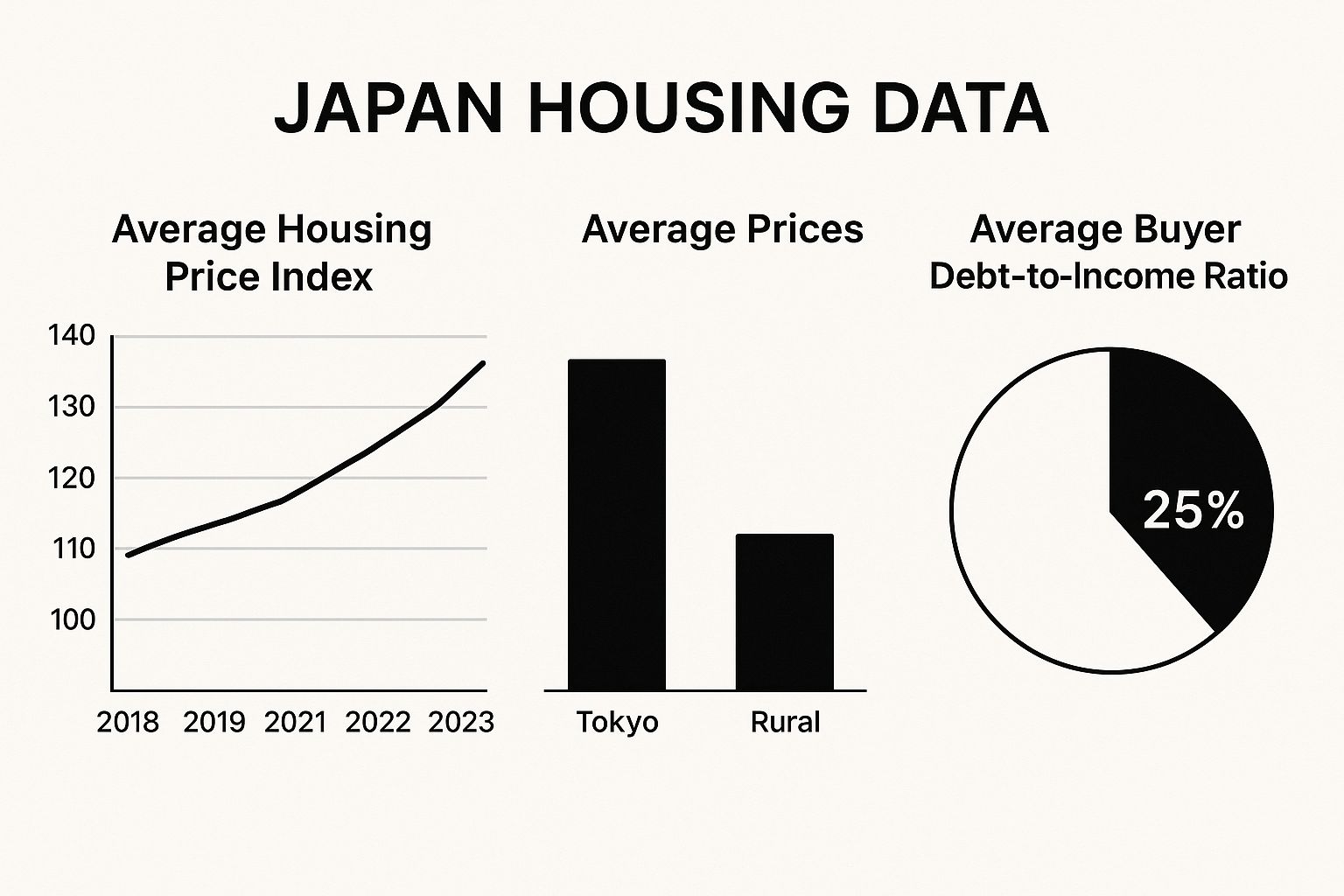

To give you a clearer snapshot of the market's pulse, here are some of the key indicators I'm watching right now.

Japan Housing Market Key Indicators at a Glance

This table breaks down the essential metrics and trends that are shaping the Japanese property market today. It’s a quick-reference guide to help you understand the forces at play.

| Indicator | Current Trend | What This Means for Buyers |

|---|---|---|

| Nationwide Price Growth | Moderate increase (4.3% year-on-year) | The overall market is healthy, but growth is concentrated in cities. Don't expect this average to apply everywhere. |

| Urban vs. Rural Prices | Widening gap | City properties are getting more expensive, while rural homes remain very affordable. Your budget will go much further outside metropolitan areas. |

| Interest Rates | Historically low | Borrowing is cheap, making it a good time to finance a purchase for both domestic and foreign buyers with access to local loans. |

| Yen Exchange Rate | Weak against major currencies | A huge advantage for international buyers. Your money buys more property, making Japan an attractive place for investment. |

| Akiya (Vacant Homes) | Increasing, especially in rural areas | A massive opportunity for bargain hunters and DIY renovators, but be prepared for potential repair costs and bureaucratic hurdles. |

As you can see, the market is full of nuances. What might be a major driver in Tokyo could be completely irrelevant in a small town in Hokkaido. This is why a one-size-fits-all approach just doesn't work here.

The Urban Boom And Its Drivers

Japan's major metropolitan areas, with Tokyo leading the pack, are in the middle of a sustained growth phase. This isn't some speculative bubble waiting to pop; it's a steady, solid climb backed by real economic factors. Super-low interest rates have made mortgages more accessible for Japanese buyers. At the same time, a weaker yen has turned Japanese real estate into a fantastic deal for international investors hunting for stable, long-term returns.

The numbers don't lie. Nationwide, house prices in Japan recently jumped by 4.3% year-on-year, a significant bump from the 2.0% growth seen just the month before. This continues a steady recovery since the pandemic, with moments of even hotter growth, like the 10.2% peak rate we saw back in April 2022. If you want to dive deeper into the data, CEIC offers detailed statistics on this trend.

This dual-market reality—urban appreciation versus rural depreciation—is the single most important concept for anyone looking to buy property in Japan. Understanding where your desired location falls on this spectrum will define your entire purchasing strategy.

The Rural Reality And The Rise Of Akiya

Move away from the neon-lit cities, and you'll find a completely different economic climate. Decades of demographic shifts have funneled people into urban centers, leaving many of Japan's regional and rural areas with shrinking populations. The direct result is a surplus of empty or underused homes, famously known as akiya (空き家).

This trend has a few key effects on the local housing markets out in the countryside:

- Price Stagnation: With far more supply than demand, property values in countless rural towns have either stayed flat or even dropped over the years.

- A True Buyer's Market: For anyone willing to look beyond the big cities, this creates an environment where you have the upper hand and plenty of room to negotiate.

- Incredible Renovation Potential: Many of these akiya are structurally sound but are just crying out for a modern touch. This is a golden opportunity for buyers who want to tackle a renovation project and create their dream home for a very low entry cost.

This split between thriving cities and quiet countrysides is the defining feature of Japan's real estate landscape. Whether you’re searching for a high-yield investment or an affordable lifestyle change, recognizing this core dynamic is your first and most critical step.

How History Forged Today's Japanese Property Market

To really get a handle on Japan's housing market, you can't just look at today's numbers. The current landscape is a direct echo of dramatic economic events that completely reshaped how an entire generation thinks about real estate. It's a fascinating story, almost like a three-act play, and each act has left a lasting mark on property values.

The first act was the notorious asset price bubble of the late 1980s. This was a wild time when real estate and stock market prices soared to unbelievable heights. Fueled by rampant speculation, it was an era where a tiny plot of land in central Tokyo was famously said to be worth more than all of California. This frenzy baked a powerful idea into the national consciousness: that property prices only ever go up.

Of course, they didn't. When the bubble spectacularly burst in the early 1990s, the second act began—a long, painful period now known as the “lost decades.” Property values didn't just fall; they crashed. In some areas, prices plunged by more than 80% from their peak. This event didn't just erase fortunes; it fundamentally rewired the Japanese relationship with real estate.

The Lasting Scars of the Bubble and Bust

The collapse of the bubble left deep, psychological scars that you can still see in the market today. It created a profound sense of caution—almost a skepticism—about property as a reliable investment.

- The Depreciation Mindset: A lot of people in Japan started viewing houses less like an appreciating asset and more like a car that loses value the moment you buy it. The real, lasting value was in the land, not the building on top.

- A Love for the New: This period cemented a cultural preference for brand-new homes, called shinchiku. Older homes (chuko) were often seen as having already shed most of their value, making them far less desirable.

- Deep-Seated Risk Aversion: An entire generation of potential buyers became incredibly wary. Many chose to hoard cash rather than invest in property, having seen so many people get burned before.

The 1990s real estate crash is the ghost that still haunts the Japanese property market. It explains why, even in a recovering market, you’ll find a level of caution and an intense focus on land value that’s rare in most Western countries.

For years, the market was stuck. Prices drifted aimlessly or slowly declined, and the frantic energy of the bubble years was gone, replaced by a quiet stillness. For nearly two decades, Japan’s housing market was defined more by its stability (or gentle decline) than by any real growth. It took a massive government push to finally change the story.

Abenomics and the Modern Revival

The third and most recent act in this drama kicked off around 2012, marking a major turning point. The comeback was sparked by a bold set of government policies championed by former Prime Minister Shinzo Abe.

This strategy, famously dubbed "Abenomics," was a multi-pronged attack to jolt the economy back to life. It involved aggressive monetary easing from the Bank of Japan, huge public infrastructure projects, and devaluing the yen. These weren't small tweaks; they were big, decisive moves that had an immediate effect on real estate. From 2012 to 2013, prices started accelerating and transaction volumes picked up. For a closer look at the data behind this policy-driven recovery, the Global Property Guide offers detailed charts.

This turnaround shows just how much Japan’s property market is tied to government strategy and global financial tides. The fresh injection of capital, combined with the buzz around major events like the 2020 Tokyo Olympics, breathed new life into urban real estate.

Suddenly, Tokyo, Osaka, and other major cities saw prices begin a steady climb, luring back both domestic and international investors. But this revival didn't erase the past. Instead, it created the dual market we have today—one where major city centers are booming, while the cautious ghost of the bust still shapes attitudes everywhere else.

The Key Drivers of Japanese Property Prices

So, why does a tiny, new apartment in central Tokyo cost more than a huge house in a sleepy country town? If you want to get your head around Japan housing prices, you have to look past the simple square footage. It’s a complex mix of location, convenience, building age, and even population trends—each playing a huge part in what a property is actually worth.

So, why does a tiny, new apartment in central Tokyo cost more than a huge house in a sleepy country town? If you want to get your head around Japan housing prices, you have to look past the simple square footage. It’s a complex mix of location, convenience, building age, and even population trends—each playing a huge part in what a property is actually worth.

That old real estate saying, "location, location, location," is almost an understatement in Japan. Here, it’s not just about the city or neighborhood; it’s about how close you are to public transport. A property's value is fundamentally tied to its walking distance from the nearest train station.

This is so central to the market that you'll see listings state the exact walking time, like "a 7-minute walk from Shinjuku Station." Believe it or not, shaving just five minutes off that walk can add a serious amount to the price tag for two otherwise identical homes. Since daily life for millions of people is built around the rail network, that easy commute is a premium worth paying for.

New Versus Old: The Shinchiku and Chuko Divide

The age of the building itself is another massive factor. In Japan, there's a strong cultural and financial preference for brand-new homes, which are called shinchiku (新築). These places are built to the very latest earthquake-resistance codes and have all the modern bells and whistles, so they naturally fetch the highest prices.

On the flip side, you have previously-owned homes, known as chuko (中古). Unlike in many Western countries where older homes can gain value, buildings in Japan have traditionally been seen as assets that depreciate over time.

The general mindset is that you are buying the land, which holds its value, while the structure sitting on it loses value every year, much like a car. This way of thinking is a holdover from the post-bubble era and the country's long history of needing to rebuild after natural disasters.

This depreciation model really shakes up the pricing. A 20-year-old house might be dramatically cheaper than a new build, even if it's been well-cared-for and sits in a fantastic location. This opens up some great opportunities for buyers who are open to older properties, especially those built after the much stricter 1981 earthquake standards were put in place.

Condos Versus Detached Houses

The type of property you’re looking at also changes the game completely. In packed urban areas, condominiums—often called "mansions" in local real estate slang—are the most common type of home. They give you security and a foothold in prime locations that would be completely out of reach if you were looking for a standalone house.

Detached houses, or ikkodate (一戸建て), give you more space and privacy, but you’ll find them more often (and more affordably) in suburban or rural areas where land isn’t so scarce. Owning an ikkodate with even a tiny garden in central Tokyo is a serious status symbol.

- Condominiums (Mansions): Their value is all about the location, building amenities (like a concierge or auto-lock security), and the quality of the building management.

- Detached Houses (Ikkodate): Here, the value is almost entirely in the land. The house itself is often considered a bonus or, in many cases, is expected to be torn down and rebuilt.

Looking at the bigger picture, Japan’s housing market is a study in contrasts. You have prices soaring in the cities while the countryside deals with a growing number of empty homes. Since late 2020, prices have been on a steady climb, though the pace has cooled a bit when you account for inflation. While Tokyo is still the most expensive market, regional hubs like Fukuoka have recently seen even faster growth. For a deeper dive into these trends, you can explore the comprehensive data from Statista.

The Powerful Influence of Demographics

Finally, you can't talk about Japanese real estate without talking about demographics. The country's aging and shrinking population is the powerful undercurrent shaping everything. It has essentially created two completely different markets.

In the big cities, a constant flow of young professionals, students, and foreign residents keeps housing demand strong, pushing prices up. These urban centers are the economic engines where the jobs and opportunities are.

It’s a totally different story in many rural regions, which are struggling with depopulation. This has led to a surge in the number of vacant and abandoned homes, known as akiya (空き家). With more houses than people, prices in these areas have flatlined or fallen, creating a true buyer's market for anyone looking for a quieter life or a bargain renovation project. This demographic split is the real key to understanding why prices vary so wildly from one part of Japan to another.

A Regional Guide to Japan Housing Prices

Talking about Japan housing prices in broad strokes is a bit like saying "it's sunny in Europe"—it doesn't tell you much. The reality on the ground is that Japan’s property market is a patchwork of incredibly different local markets. Each region has its own unique flavor, price points, and lifestyle, and the cost can swing dramatically from one prefecture to the next.

Let's start with the undisputed heavyweight: Tokyo. The capital is a perfect example of Japan's dual market, all within one city. In the prestigious central wards like Minato, Chiyoda, and Shibuya, prices are frankly astronomical. You're not just buying a place to live; you're buying a piece of a global hub for finance, culture, and convenience. A relatively small, new condo here can easily start at ¥1.5 million per square meter.

But you don't have to go far for that picture to change completely. Hop on a train for 30 minutes, and you're in the Greater Tokyo Area, which includes prefectures like Kanagawa, Saitama, and Chiba. Here, prices become much more grounded. You can find fantastic homes in lovely suburban cities with easy commutes into central Tokyo, often for half the price.

Beyond Tokyo: Other Major Urban Hubs

While Tokyo grabs all the headlines, other major cities offer compelling, and often more affordable, alternatives.

- Osaka: As Japan's second-largest metro area, Osaka boasts a vibrant, famously friendly culture and a powerhouse economy. The key difference? Housing is significantly more affordable than in Tokyo, with new condos often priced 20-30% lower. With major redevelopment projects underway, it's a city many are watching for future growth.

- Nagoya: Tucked between Tokyo and Osaka, Nagoya is an industrial and manufacturing giant. Its property market is known for being remarkably stable. It offers a balanced investment with solid rental income potential, but without the sky-high price tags of the capital.

These cities deliver a rich urban experience, just with a slightly more relaxed vibe and a much lower barrier to entry. This makes them a hit with both Japanese families and savvy foreign investors.

To give you a clearer sense of how these costs stack up, here’s a table comparing average prices for a standard condominium and a detached house in key cities. It really helps visualize the cost differences.

Average Housing Price Comparison Across Major Japanese Cities

| City | Avg. Condo Price (70m²) | Avg. Detached House Price | Market Characteristics |

|---|---|---|---|

| Tokyo (23 Wards) | ¥80 - ¥120 million | ¥90 - ¥150 million+ | Global financial hub; highest demand and prices. |

| Osaka | ¥45 - ¥65 million | ¥50 - ¥75 million | Strong economy, more affordable than Tokyo, vibrant culture. |

| Nagoya | ¥40 - ¥60 million | ¥45 - ¥65 million | Stable industrial hub with steady demand. |

| Fukuoka | ¥35 - ¥55 million | ¥40 - ¥60 million | Rapidly growing "startup city" with high quality of life. |

| Sapporo | ¥30 - ¥45 million | ¥35 - ¥55 million | Lifestyle-focused, affordable, popular for nature lovers. |

As you can see, your budget stretches a lot further once you move away from the intense competition of the Tokyo market.

It's all about perspective. A budget that gets you a small studio apartment in central Tokyo could easily secure a spacious family home in a city like Fukuoka or Sapporo, maybe even with a little garden.

This visual breakdown of nationwide trends gives you a great snapshot of the urban-rural price divide and what's considered affordable for most buyers.

The data really drives home one point: location is the single biggest lever you can pull to control your costs.

Rising Stars and Regional Gems

Looking beyond the "big three" of Tokyo, Osaka, and Nagoya, you'll find several regional cities that are quickly gaining fame for their amazing quality of life, growing economies, and appealing house prices. These places often give you the best of both worlds—all the city amenities you need, with stunning nature right on your doorstep.

Fukuoka, on the southern island of Kyushu, is consistently voted one of Japan's most livable cities. It has a young vibe, a booming startup scene, and fantastic connections to the rest of Asia. This has fueled incredible growth in its property market, with prices sometimes rising faster, percentage-wise, than even Tokyo.

Head north, and you'll find Sapporo in Hokkaido, which offers a completely different experience. Famous for its snowy winters, breathtaking landscapes, and incredible food, Sapporo provides an exceptional lifestyle for a fraction of what you'd pay elsewhere. It's a top choice for anyone looking for a change of pace or a beautiful vacation home.

Finally, for those with an adventurous streak and a tighter budget, Japan's countryside is filled with opportunities. If you're open to an older home or a fixer-upper, our guide on how to find a cheap home in Japan has practical tips for unearthing hidden gems. Finding a large, traditional house for a surprisingly low price is one of the most unique and exciting aspects of the Japanese market.

Your Step-by-Step Guide to Buying Property in Japan

So, you're thinking about buying a home in Japan. At first glance, the process can look a bit intimidating, but it’s actually a very clear, well-trodden path. With a bit of guidance, you can absolutely go from researching Japan housing prices to getting the keys to your new place. Let's walk through what that journey looks like, especially for a foreign buyer.

Your first move—and honestly, the most important one—is to find a reliable, licensed real estate agent, known in Japan as a fudousan gaisha. A great agent is so much more than a salesperson. Think of them as your guide on the ground, your cultural interpreter, and your biggest advocate. They’re essential for handling the mountain of paperwork, negotiating on your behalf, and bridging any language gaps you might encounter.

Once your agent helps you zero in on a property you love, the next step is to submit a Letter of Intent to Purchase (kainushi kouho todoke). This isn't a binding contract, but it signals your serious interest and lays out your offer. It's the official starting gun for negotiations.

Understanding the Legal Framework

Once the seller agrees to your terms, things get more official. Your agent will then draft what is arguably the most critical document in the whole process: the Explanation of Important Matters, or juuyou jikou setsumeisho. This is an incredibly detailed legal disclosure covering everything you could possibly want to know about the property—from zoning laws and boundary lines to any known issues or defects.

By law, a licensed professional has to sit down and go through this document with you before you sign anything final. This step is purely for your protection, making sure you're walking in with your eyes wide open. Don't be afraid to ask questions; if your Japanese isn't perfect, this is the time to bring in a translator.

The 'juuyou jikou setsumeisho' is your ultimate safety net. It legally obligates the seller and agent to disclose all pertinent facts about the property. Rushing through this step is a common mistake; take your time to digest every detail.

After you've gone through the explanation, it's time for the formal sales contract. This is when you'll pay a deposit, which is usually 10-20% of the purchase price. Once that's paid, the deal is legally binding for both you and the seller.

Financing and Ownership Types

For many foreigners, getting a loan can be the biggest hurdle, particularly if you don't have permanent residency. Some of the big Japanese banks can be hesitant, but others are more open to it, especially if you have a Japanese spouse or hold a stable, long-term visa. It’s a good idea to start looking into your financing options very early on.

You’ll also want to get clear on what kind of ownership you’re buying. There are two main types in Japan:

- Freehold (shoyuken): This is what most people are after. It means you own both the building and the land it stands on, forever. It's yours, outright.

- Leasehold (shakuchiken): With a leasehold, you own the building itself, but you're only leasing the land for a fixed term, often for many decades. The initial price is lower, but you'll have to factor in regular land rent payments.

The final lap is the settlement. This is where you pay the remaining balance and all the related fees. A judicial scrivener (shihoushoshi) then handles the final step: registering the property transfer in your name at the local Legal Affairs Bureau. Just like that, it's officially yours.

While this whole journey can feel complex, our detailed guide on buying a house in Japan as a foreigner provides even more in-depth advice to see you through. One last tip: be ready for closing costs. Things like agent commissions, registration taxes, and stamp duties can add another 6-8% to the property's price. Budgeting for these from the start will save you a lot of headaches later on.

Answering Your Top Questions About Buying in Japan

Diving into the Japanese property market naturally brings up a lot of questions. Once you move past the price charts and regional maps, you’re probably thinking about the future, whether you can even buy as a foreigner, and if it's a smart financial move.

Think of this as your practical Q&A session. We're tackling the big questions that come up when you start getting serious about buying property in Japan. Let's dig into market forecasts, the real-world process for foreign buyers, and what you can expect from your investment.

What Are the Future Prospects for Japan Housing Prices?

Predicting any market’s future is never an exact science, but for Japan housing prices, the trends point toward a "tale of two markets" that's likely to continue.

For major urban hubs like Tokyo, Osaka, and Fukuoka, the outlook is still quite positive. These cities are economic powerhouses, constantly drawing in young professionals, students, and international residents. This steady influx keeps the demand for housing strong.

Several things are propping up this urban growth:

- Sustained Demand: Great jobs and vibrant lifestyles will keep pulling people into the big cities, putting natural upward pressure on property values.

- Foreign Investment: The weak yen has made Japanese real estate a real bargain for international buyers. As long as that's the case, expect foreign capital to keep flowing into prime urban markets.

- Tourism's Impact: A red-hot tourism sector gives local economies a shot in the arm and drives demand for short-term rentals, which helps support prices in popular destinations.

On the flip side, rural and less-populated regions face a different reality. Depopulation is a powerful force that isn't going away, meaning many smaller towns will continue to see a surplus of vacant homes, known as akiya. In these areas, prices will likely stay flat or even decline. This creates a buyer's market overflowing with affordable opportunities, but with very little hope for a big return on your investment down the road.

The most important thing to remember for the future is that location is everything. A property's long-term value will almost entirely depend on whether it’s in a growing urban center or a shrinking rural town.

Can a Foreigner Really Buy a House in Japan?

Yes, absolutely. From a legal standpoint, there are no restrictions on foreigners owning freehold property in Japan. It doesn’t matter if you’re a resident or living halfway across the world—you have the same rights to purchase land and buildings as a Japanese citizen. This open-door policy makes Japan one of the most welcoming countries in Asia for international property buyers.

However, while there are no legal barriers, there are some very real practical ones to plan for. The single biggest challenge for most non-residents is getting a mortgage from a Japanese bank.

Financial institutions are understandably cautious about lending to people without long-term residency or a solid financial history in Japan. If you don't have permanent residency, a Japanese spouse, or a stable, high-paying job with a Japanese company, securing a loan is tough. This is why many foreign buyers simply purchase with cash.

Also, the entire process—from viewing to closing—is conducted in Japanese. All the legal paperwork, including the critical Explanation of Important Matters and the final sales contract, will be in Japanese. You absolutely need a reliable, bilingual real estate agent and may even want a professional translator to ensure you understand every clause. A good first step is to get familiar with the types of questions to ask before buying a home in Japan to make sure you and your agent are on the same page.

Is Japanese Real Estate a Good Investment Right Now?

Whether buying property in Japan is a "good" investment really comes down to what you're trying to achieve. The market presents very different opportunities—and risks—depending on your personal goals.

The Pros: Why It Could Be a Great Investment

- Attractive Rental Yields: In cities like Tokyo and Osaka, consistent rental demand can provide a stable and predictable income. Gross rental yields in Tokyo often fall between 2% and 5%, which is quite competitive for a major global city.

- Capital Gains Potential in Cities: If you're playing the long game, prime properties in central urban locations have a solid track record of appreciation. Buying in a popular Tokyo ward or a rising city like Fukuoka could pay off.

- The Weak Yen Advantage: For anyone holding foreign currency, the current exchange rate is like a massive sale. Your dollars or euros stretch much further, creating a unique window of opportunity to get more for your money.

The Cons: Risks to Consider

- Depreciation Risk in Rural Areas: Step outside the major cities, and property values are more likely to fall over time. The building itself is generally seen as a depreciating asset, and in areas with shrinking populations, the land value may not be enough to stop the slide.

- Liquidity: Selling a property in a less popular or rural location isn't always quick. If you need to sell fast, you might have to accept a lower price.

- Management and Upkeep: If you're an overseas owner, you have to budget for property management fees. And for older homes, especially akiya, the cost of renovations and maintenance can add up quickly.

In short, Japan offers compelling prospects for those seeking steady rental income or capital growth in a top-tier city. For bargain hunters who just want a lifestyle property, the low cost of entry in the countryside is truly unbeatable.