Your Guide to Retiring in Japan

Dreaming of retiring in Japan? This guide breaks down the visa process, finances, housing, and healthcare to help you plan your new life abroad.

Posted by

So, you're dreaming of a retirement filled with tranquil temples and vibrant city life in Japan. It’s an incredible goal, and absolutely achievable, but it requires a slightly different approach than you might think. The single most important thing to understand upfront is that Japan does not offer a dedicated retirement visa.

This trips a lot of people up. You can't just show proof of funds and move. Instead, you have to find another pathway to long-term residency. This usually means qualifying for a visa based on your professional skills, business investments, or family ties before you hang up your work boots for good.

What It Really Takes to Retire in Japan

Making the leap to retire in Japan means getting familiar with its unique social and legal systems. Your strategy for securing long-term residency will hinge entirely on your personal circumstances—your career, your financial standing, or your family connections.

For some, the answer lies in leveraging a distinguished career to get a Highly Skilled Professional (HSP) visa. This is a points-based system that can be a fast track to permanent residency. For others, marrying a Japanese national or having Japanese ancestry provides a more straightforward path. The key is to shift your thinking from "how to retire in Japan" to "how to secure long-term residency in Japan."

Understanding Japan's Super-Aged Society

To truly plan for your future here, you need to understand the country's demographic landscape. Japan is what's known as a "super-aged society," meaning more than 20% of its population is over 65.

This isn't just a statistic; it shapes daily life. By 2025, it's predicted that nearly 29% of the population will be 65 or older. This demographic shift has prompted the government to raise the standard retirement age and puts a strain on the national pension and healthcare systems. You can dive deeper into Japanese retirement trends to see the full picture.

While the world-class healthcare system is under pressure, this also means Japan is incredibly well-equipped for seniors. The infrastructure, public services, and overall community focus create a safe, comfortable, and accommodating environment for older residents.

The Bottom Line: Don't get discouraged by the lack of a retirement visa. Your entire focus should be on identifying an alternative long-term visa you can qualify for while you're still working or have the necessary qualifications.

A Quick Glance at the Visa Options

Since there's no direct retirement visa, let's look at the most common routes people take to secure long-term residency. Each has its own set of requirements, so finding the right fit is crucial.

Viable Visa Pathways for Retirees in Japan

| Visa Type | Primary Requirement | Best Suited For... | Key Considerations |

|---|---|---|---|

| Highly Skilled Professional (HSP) | Points-based system rewarding advanced degrees, high salary, and professional achievements. | Accomplished professionals in fields like tech, research, or management. | Aim to secure this visa and then apply for Permanent Residency (PR) after 1-3 years. |

| Business Manager | A concrete business plan and a capital investment of at least ¥5 million (around $32,000 USD). | Entrepreneurs who want to start or manage a business in Japan. | Requires active management of the business; not a passive investment visa. |

| Spouse of a Japanese National | Legally married to a Japanese citizen. | Individuals with a Japanese spouse. | This is one of the most direct routes to long-term residency and eventually PR. |

| Long-Term Resident | Varies; often granted for humanitarian reasons or to those with Japanese ancestry. | Individuals of Japanese descent (Nikkei) or those with unique family circumstances. | Eligibility is determined on a case-by-case basis by the immigration authorities. |

This table should give you a starting point for figuring out which path makes the most sense for your situation. Early research and planning are your best friends here.

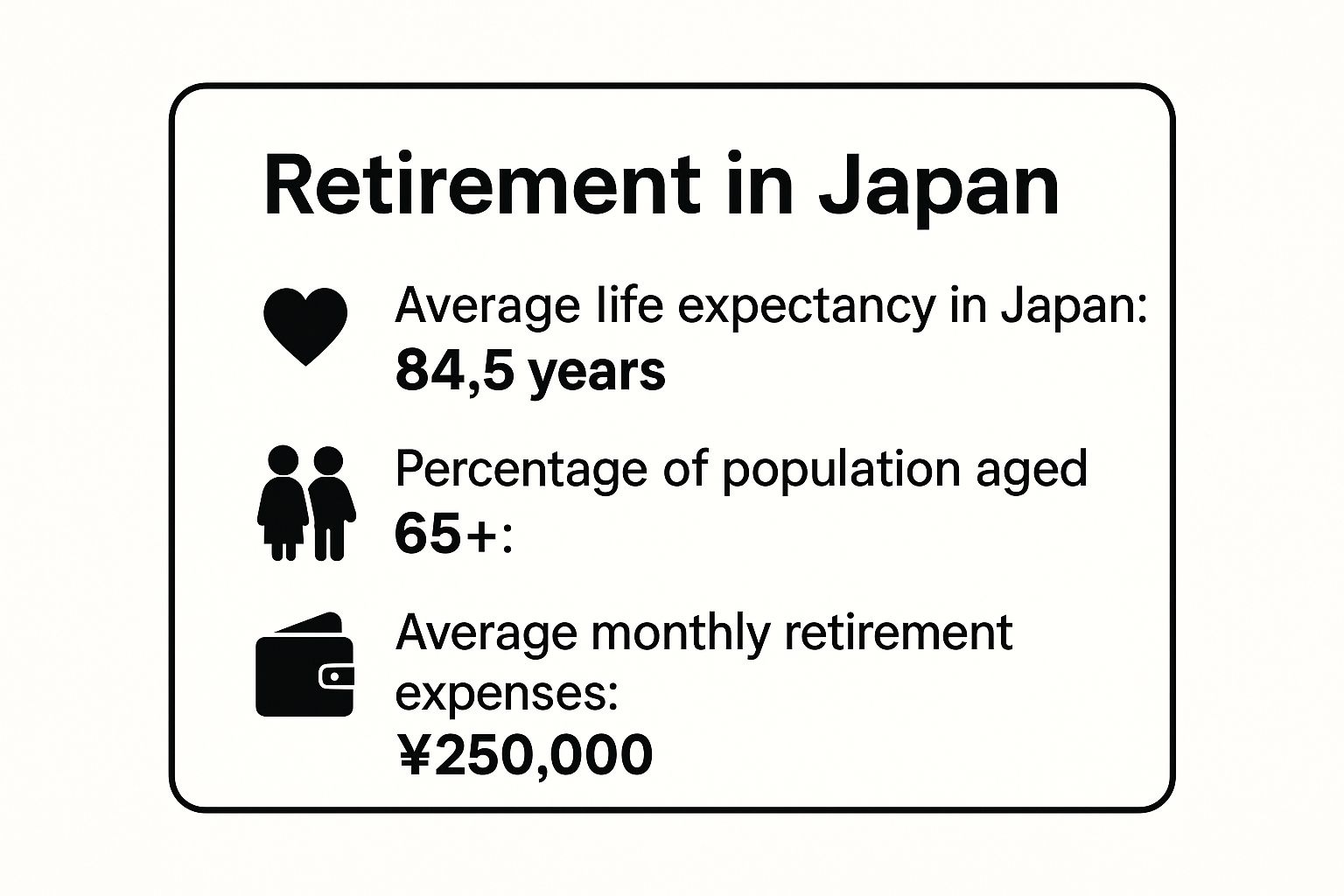

Key Statistics for a Japanese Retirement

To help you ground your financial planning in reality, here are some essential figures about life in Japan.

These numbers underscore Japan's high life expectancy and relatively moderate living costs, but they also show just how significant the senior population is. All of this plays into the kind of life you can expect to build here.

So, is it possible? Absolutely. But it’s a project that demands proactive, strategic planning. Your journey begins the moment you start building a clear, realistic roadmap to securing that all-important residency status.

Navigating Japan's Visa and Residency Maze

Alright, let's talk about the biggest hurdle you'll face: securing your legal status to live in Japan long-term. The first thing to know is that Japan doesn't offer a straightforward "retirement visa" like some other countries. This means we have to get a bit creative.

Your goal isn't to find a retirement visa that doesn't exist, but to secure a status of residence that allows you to stay indefinitely. The most effective strategy is often to leverage your professional life before you officially hang it up for good. Think of it as using your career history or personal connections as the key to unlocking your new life in Japan.

Let's break down the most common and practical ways to make this happen.

The Highly Skilled Professional (HSP) Visa Path

For anyone with a solid career behind them, the Highly Skilled Professional (HSP) visa is probably the most powerful tool in the toolbox. Now, it's not a visa you apply for directly. Instead, you get a standard work-related visa and, at the same time, ask to be evaluated under a points-based system.

This system is designed to attract top talent by awarding points for things like your education, years of professional experience, and salary. The magic number you're aiming for is 70 points. You can play around with the numbers yourself using the official Immigration Services Agency of Japan points calculator.

Here’s a quick look at how the points can stack up:

- Academic Background: A doctorate degree alone can net you 30 points.

- Professional Experience: 10 years in your field could add another 20 points.

- Annual Salary: A salary of ¥8 million (roughly $51,000 USD) for someone in their late 30s might contribute 30 points.

Hitting 70 points grants you HSP status, which comes with some fantastic perks—most notably, a much faster path to Permanent Residency. If you can score 80 points or more, you can apply for a Permanent Resident visa in just one year.

How the HSP Visa Works in a Real-World Scenario

Let's imagine a semi-retired IT consultant named Alex, who is 55. His plan is to work part-time for a Japanese tech firm for a few years before fully retiring.

Here's how his profile breaks down in the points system:

- Education: Alex has a Master's degree, giving him 20 points.

- Experience: With over 20 years in the IT field, he gets another 25 points.

- Salary: His part-time contract is for ¥7 million annually, which adds 25 points.

With a total of 70 points, Alex is in. He qualifies for the HSP visa. After he maintains that status for three years, he's eligible to apply for Permanent Residency. Once that's approved, he's set—he can live in Japan for the rest of his life, no work required.

Tapping into Family and Ancestral Connections

If you happen to have a Japanese spouse or parent, your path is dramatically simpler. The Spouse or Child of a Japanese National visa is one of the most stable and direct routes available. It grants a renewable status of residence and puts you on a clear track to Permanent Residency.

Another option exists for those of Japanese descent (second or third-generation, often called Nikkei). You may be eligible for the Long-Term Resident visa. This is decided on a case-by-case basis, so you'll need solid documentation to prove your ancestry. Both of these visas bypass the professional and financial hurdles of the work-based options.

My Two Cents: The Japanese immigration system really values tangible connections. Whether you're demonstrating your value through professional skills, a business plan, or family ties, your application needs to tell a convincing story about your commitment to building a stable, long-term life in Japan.

When to Bring in an Immigration Lawyer

While you can certainly tackle the visa process on your own, Japan's bureaucracy is notoriously complex and unforgiving. This is where an immigration lawyer, known as a gyoseishoshi, can be worth their weight in gold.

You should seriously think about hiring one if:

- Your situation isn't straightforward (maybe you're self-employed or just shy of the points threshold).

- You aren't confident in your Japanese language skills or your ability to handle mountains of paperwork.

- You simply want the peace of mind that comes from maximizing your chances of success.

These professionals live and breathe the intricacies of the immigration system. They know how to position your application in the best possible light, helping turn a bewildering process into a clear, manageable plan.

Nailing Down a Realistic Retirement Budget

You've navigated the visa process—a huge win. But now comes the part that truly determines your day-to-day comfort in Japan: building a budget that’s grounded in reality, not just wishful thinking.

One of the biggest misconceptions is that Japan is uniformly expensive. The truth is, your cost of living will swing wildly depending on where you plant your roots. A comfortable retirement in the heart of Tokyo might require a monthly budget of ¥350,000 to ¥450,000 (roughly $2,250 - $2,900 USD).

Head to a smaller city in Kyushu or a town in Hokkaido, though, and that number changes dramatically. You could live quite comfortably on ¥200,000 to ¥280,000 per month (around $1,300 - $1,800 USD). The primary driver of this difference? Housing, by a long shot.

Your Monthly Expenses, Item by Item

Let's get granular. Averages are helpful, but your actual budget will be built on specific, predictable costs. To give you a real-world picture, here’s what a monthly budget might look like for a single person living a modest but comfortable life outside of Japan's biggest metro areas:

- Housing (Rent): ¥70,000 - ¥90,000 for a clean, modern one-bedroom apartment.

- Utilities (Gas, Electric, Water): ¥12,000 - ¥15,000. Expect this to creep up in the winter months.

- Groceries: ¥40,000 - ¥50,000 if you stick to local, seasonal foods.

- Transportation: ¥10,000 for a public transit pass, assuming you rely on trains and buses.

- Health Insurance (NHI): ¥15,000 - ¥25,000. This is a big one, as it’s tied directly to your declared income.

- Phone & Internet: ¥8,000 for a reliable connection.

- Discretionary Spending: ¥30,000 for enjoying life—think dining out, hobbies, and the occasional weekend trip.

This puts a baseline monthly total somewhere between ¥185,000 and ¥228,000. Housing will always be your biggest variable. For a much deeper look, our guide to Japan housing prices across different prefectures breaks down what you can expect to pay.

One crucial point to remember: Many local Japanese retirees own their homes, which slashes their monthly outgoings. As an expat, you’ll most likely be renting at first, adding a significant fixed cost that your Japanese neighbors might not have.

Getting Your Money to Japan

Once you have a grip on your expenses, the next piece of the puzzle is figuring out how to manage your income from abroad. This means dealing with pensions, social security, and the unavoidable reality of currency exchange rates. A little bit of setup here goes a long way.

One of your first tasks in Japan will be to open a local bank account. You can go with the big names like MUFG, SMBC, or Mizuho, but don't overlook online-first options like Sony Bank or Rakuten Bank. They often have better English support and more competitive rates for international transfers.

To move your retirement funds, don't just rely on a standard bank wire. Services like Wise (formerly TransferWise) or Revolut are designed for this and can save you a small fortune in fees and poor exchange rates. Many expats find it's better to transfer larger sums quarterly instead of monthly to reduce transaction fees and smooth out currency fluctuations.

Understanding the Local Money Mindset

It's also worth understanding how the locals approach their finances. A 2024 survey showed that Japanese retirees hold average savings of about ¥18,357,114 (roughly $127,910 USD).

What’s really telling, though, is that the same study found that 90% of respondents were worried about future tax hikes eating into their retirement savings. It's a concern you should share and factor into your own long-term planning. You can dig into the specifics in the full retirement survey report.

This points to a culture of careful saving mixed with a healthy dose of anxiety about financial security. By building a detailed budget, setting up smart cross-border banking, and keeping local economic realities in mind, you can put yourself in a position to not just survive, but truly thrive during your retirement in Japan.

Finding Your Perfect Home in Japan

Choosing where to put down roots is easily the most exciting part of planning your retirement in Japan. The housing market here definitely has its own rhythm and customs, but whether you decide to rent or buy, you can find a place that truly feels like your own personal sanctuary.

For most people moving to a new country, renting is the most sensible first step. It buys you time and flexibility, letting you get a real feel for a neighborhood—or even an entire city—before you decide to plant your flag permanently. Just be aware that the Japanese rental process comes with some unique upfront costs that can be a real shock if you’re not ready for them.

These initial fees often pile up to the equivalent of three to five months' rent, all due before you even get the keys. Knowing what’s coming is the key to a smooth start.

Decoding the Japanese Rental Market

When you find that perfect apartment, don’t expect to just pay the first month's rent and a security deposit. The system here includes several non-refundable fees that are standard practice nearly everywhere.

Here’s a quick rundown of what to budget for:

- Reikin (礼金) or "Key Money": Think of this as a one-time, non-refundable gift to the landlord. It’s usually equal to one or two months' rent. This is an old custom, and the good news is it's slowly becoming less common, especially outside of the major city centers.

- Shikikin (敷金) or Security Deposit: This one is more familiar. It’s typically one month's rent and is mostly refundable when you move out, minus any costs for cleaning or repairs.

- Hoshonin (保証人) or Guarantor: Landlords want a guarantor to cover your rent if you can't pay. Since most foreigners don't have a Japanese family member to co-sign, you'll need to use a guarantor company (hoshō-gaisha). The fee for this service is usually 50% to 100% of one month's rent.

- Chukai Tesuryo (仲介手数料) or Agency Fee: This is simply the real estate agent's commission. By law, it's capped at one month's rent plus tax.

So, let's put that into practice. Say you find a great little apartment in a Kyoto suburb for ¥80,000 a month. Your initial outlay could easily top ¥320,000 (roughly $2,050 USD) once you add everything up. It’s a hefty investment just to get in the door.

The Path to Homeownership as a Foreigner

Buying a home in Japan might sound complicated, but here’s the best part: there are no legal restrictions on foreigners owning property. Your visa or residency status has zero impact on your ability to purchase land or a house.

The real hurdle, if there is one, is getting a mortgage. Most Japanese banks are quite reluctant to lend to anyone who isn't a permanent resident. Because of this, many foreign buyers—especially retirees—opt to purchase their homes with cash. If that’s your plan, having your funds ready to go is crucial. For a much deeper dive into the nuts and bolts, our guide on buying a house in Japan as a foreigner walks you through every step.

For many retirees, buying a home isn't just a financial decision; it’s about putting down roots. Owning your property provides a sense of stability and eliminates the recurring costs and uncertainties of the rental market.

As you begin your property search, you’ll mainly come across two different types of homes.

Comparing Property Types

| Property Type | Description | Pros | Cons |

|---|---|---|---|

| Mansion (マンション) | A modern apartment or condo in a multi-unit building. | Low maintenance, good security, often located near public transport. | Less privacy, monthly management fees (kanri-hi), smaller living space. |

| Ikkodate (一戸建て) | A standalone, single-family house. | More space, privacy, often includes a small garden or parking spot. | Higher maintenance responsibility, may be located further from city centers. |

Ultimately, the choice between a sleek mansion in downtown Fukuoka or a charming ikkodate in a quiet coastal town comes down to the kind of life you see yourself living. Both paths offer a wonderful foundation for a fulfilling retirement in Japan.

Getting to Grips with Japanese Healthcare and Wellness

When you’re thinking about retiring to a new country, healthcare is usually right at the top of the list of concerns. The good news? Japan has one of the world's most efficient and accessible healthcare systems, and it’s a big reason why people here enjoy such long, healthy lives.

The whole system is built on a mandatory public insurance program. Every single person living in Japan, including foreign retirees with long-term residency, has to be enrolled. This is a huge source of peace of mind, as it guarantees everyone has access to affordable medical care. As a retiree, you'll almost certainly be part of the National Health Insurance scheme.

This system isn't just a policy—it's a fundamental part of life in Japan and a massive perk for anyone planning to spend their retirement here.

How National Health Insurance Works for You

Most retirees, along with self-employed folks and students, will join the National Health Insurance (NHI), or Kokumin Kenko Hoken. Getting signed up is surprisingly straightforward. Once you’ve registered your address at your local city or ward office, you'll complete the NHI enrollment right there.

They’ll hand you an insurance card, which you'll need to show every time you visit a doctor or dentist. The real magic of the NHI is that it covers a flat 70% of most medical and dental bills. This means when you get a check-up or a prescription filled, you only pay the remaining 30% out-of-pocket.

Your monthly premium is calculated based on a few factors, like your income from the previous year, your age, and how many people are in your household. If your main income is a pension from your home country, don't worry—the staff at your local municipal office can walk you through how to declare it so they can figure out your premium.

Topping Up Your Coverage for Complete Peace of Mind

While the NHI provides fantastic baseline coverage, some retirees choose to buy private insurance to cover the remaining gaps. Think of it as an extra layer of security.

A private plan might be a good idea if you’re looking for:

- Help with the 30% co-payment: Some policies are designed specifically to cover these out-of-pocket costs.

- Private hospital rooms: NHI generally only covers a bed in a shared room.

- Coverage for advanced medical treatments: Certain experimental or highly specialized procedures might not be included in the public plan.

There are plenty of Japanese and international insurance companies that offer plans specifically for foreign residents. It's not a must-have for everyone, but it’s definitely worth looking into to make sure your healthcare plan fits your personal needs and budget.

Japan’s healthcare system is consistently ranked as one of the best in the world for both quality and accessibility. You're almost never far from a clinic or hospital, and it’s often possible to get a same-day appointment, even with a specialist.

Planning Ahead for Long-Term Care

Another crucial piece of the puzzle for retirees is Japan's Long-Term Care Insurance (LTCI) system, known locally as Kaigo Hoken. This is a mandatory program for everyone aged 40 and over. The cost is handled through a small additional premium that's collected right alongside your NHI payments.

When you reach age 65, or if you develop certain age-related conditions earlier, you can apply for certification to receive care benefits. Once you're approved, the system covers a huge portion of the costs for services like:

- In-home nursing visits

- Assistance with daily tasks like shopping and cleaning

- Adult daycare services at local community centers

- Short-term stays at dedicated care facilities

It's a really forward-thinking system designed to help seniors maintain their independence for as long as possible. This incredible safety net is another powerful reason why Japan is such a secure and appealing place to enjoy your retirement.

Embracing Daily Life and Local Culture

Getting through the paperwork and logistics of your move is a huge milestone, but the real adventure begins when you start to build a life here. Settling in means more than just finding a place to live; it's about finding your rhythm and your people, turning a new address into a real home.

This is where the magic happens. It’s in the small victories—mastering the train system, figuring out the unspoken rules of the local grocery store, or having your first friendly chat with a neighbor. These everyday moments are what truly ground you in your new life.

Learning the Language

Let's be honest: while you can certainly navigate Tokyo or Kyoto with just English, learning some Japanese will completely transform your retirement. It’s the key that unlocks deeper connections and helps you handle day-to-day life with so much more confidence.

Don't feel pressured to become fluent overnight. The goal is connection, not perfection. Just starting with a few basic greetings will go a long way.

- Community Centers: Your local city or ward office is a goldmine. They often host free or incredibly cheap Japanese classes specifically for foreign residents.

- Language Apps: Apps like Duolingo or Memrise are fantastic for picking up vocabulary while you're on the train or waiting in line.

- Private Tutors: If you prefer a more focused approach, a platform like italki can connect you with a tutor for one-on-one lessons that fit your schedule.

Making an effort, even a small one, is always noticed and appreciated. It can change a simple transaction at the post office into a warm, human interaction, which makes all the difference.

Embracing the local culture isn't about giving up who you are. It’s about adding a new, fascinating layer to your life. From my experience, the retirees who thrive here are the ones who stay curious, patient, and open to new ways of doing things.

Building Your Social Circle

Making friends as an adult is tough no matter where you live, but Japan is full of opportunities if you know where to look. The trick is to put yourself out there and find activities that you genuinely enjoy. Community is everything in Japanese society, and there’s a group for just about any hobby you can think of.

A great place to start is by joining a local club, or sākuru. These community groups are a cornerstone of social life here.

- Sports & Fitness: You'll find local clubs for hiking, table tennis, and even gateball—a huge favorite among Japan's active seniors.

- Arts & Crafts: Why not try a workshop for calligraphy (shodō), flower arranging (ikebana), or pottery? They're wonderful, hands-on ways to connect with people.

- Cultural Events: Don't miss the local festivals, or matsuri. They are the perfect, relaxed setting to meet your neighbors and experience local traditions firsthand.

These connections are the foundation of a truly happy retirement. To get a better sense of it all, you can read more about what life in Japan as a foreigner actually feels like. It’s these small steps—a shared hobby, a simple greeting—that build a rich and connected life.

Answering Your Top Questions About Retiring in Japan

As you get deeper into planning your retirement in Japan, a lot of specific questions are bound to pop up. It's completely normal. Let's walk through some of the most frequent ones I hear to help you gain a clearer picture of what to expect.

Is It Possible to Retire in Japan on Social Security Alone?

This is a big one. The short answer is: it’s tough, but not entirely out of the question. It all comes down to your lifestyle expectations and, crucially, your location.

If you’re dreaming of a quiet life in a rural town with a lower cost of living, you might be able to make a modest pension stretch. But if you have your heart set on Tokyo or another major city, relying solely on something like U.S. Social Security will leave you feeling the pinch. It just won’t be enough to live comfortably.

Most people who successfully retire here find they need to supplement their pension with savings, investments, or other income streams. The best advice I can give is to create a brutally honest budget for your target location and see how the numbers stack up against your guaranteed income.

How Important Is It to Speak Japanese?

You can get by in the big cities with English, especially in tourist-heavy areas. But "getting by" is very different from truly living here. Learning the language will fundamentally change your retirement for the better.

Think about the day-to-day stuff: dealing with city hall paperwork, talking to a doctor about your health, or just chatting with your neighbors. Without some Japanese, these simple tasks become major logistical challenges.

Honestly, the language barrier is one of the biggest reasons expats feel isolated. Making a real effort to learn Japanese isn't just practical—it's the single best investment you can make in your own happiness and integration into the community.

What Happens to My Visa When I Retire?

This is a critical detail that trips a lot of people up. Most long-term visas are directly linked to your job. The moment you stop working, that visa becomes invalid.

This is exactly why securing Permanent Residency (PR) is the golden ticket for anyone serious about retiring in Japan. With PR, your right to live here is no longer tied to an employer, a spouse, or a business venture.

It’s the key that unlocks true freedom. It means you can stay in Japan for good, whether you choose to work part-time or not at all, giving you the stability and peace of mind you need for a secure retirement.