Your Guide to a Tokyo Condo for Sale

Searching for a Tokyo condo for sale? This guide covers the entire process, from understanding the market and securing financing to navigating legal steps.

Posted by

If you're starting the search for a Tokyo condo for sale, you’re stepping into one of the world's most dynamic and fascinating property markets. Prices are on the move and sales are brisk, so getting a solid feel for the current landscape isn't just helpful—it's essential before you dive in.

Getting to Know the Tokyo Condo Market

Before you even think about scrolling through listings, it pays to understand the forces at play across Tokyo’s 23 wards. This isn’t one big, uniform market. The factors driving the price of a brand-new tower in Shinjuku are completely different from what affects a pre-owned flat in a quiet residential area like Setagaya.

Building this foundational knowledge helps you set realistic expectations from day one. It’s about looking past the price tag and understanding the why behind it, which is the key to making a smart investment.

Key Market Indicators to Watch

A few key metrics can tell you almost everything you need to know about the health of the market. For Tokyo, the two most important numbers are the price per square meter and the total sales volume. Together, they paint a clear picture of demand, buyer confidence, and overall market direction.

The data below gives a high-level view of what's been happening recently.

Tokyo Condo Market Snapshot

| Metric | New Condominiums (Greater Tokyo) | Pre-Owned Condominiums (Tokyo's 23 Wards) |

|---|---|---|

| Average Price | ¥75.66 million (up 28.8% YoY) | ¥68.45 million (up 5.8% YoY) |

| Price Per Square Meter | ¥1,139,000 (up 27.6% YoY) | ¥1,073,500 (up 7.6% YoY) |

| Units Sold | 1,496 units (up 52.3% YoY) | 1,518 units (up 7.5% YoY) |

| Month of Data | April 2024 | April 2024 |

Source: Real Estate Economic Institute & REINS

As you can see, both new and existing condos are in high demand, with prices and sales activity showing strong upward momentum. This tells us it's a competitive environment, which is crucial context for any potential buyer.

New Builds vs. Pre-Owned Condos

One of the first big decisions you'll make is whether to hunt for a brand-new (shinchiku) condo or a pre-owned (chuuko) one. They both have their own appeal and will shape your search, budget, and even your lifestyle.

-

New Condominiums: These apartments come with all the latest building tech, modern amenities, and sleek designs. They're often built near major train stations and, of course, you get to be the very first person to live there. The flip side is a premium price tag and sometimes smaller floor plans compared to older buildings.

-

Pre-Owned Condominiums: You'll often find these in well-established, desirable neighborhoods, and they can offer significantly more space for your money. They also give you the chance to buy into a building with a proven track record for its management and community. The trade-off might be the need for a few renovations or dealing with slightly older (but often perfectly fine) infrastructure.

Ultimately, the new-versus-used debate comes down to what you value most. Are you looking for a turnkey, modern home with all the bells and whistles? Or do you prioritize more living space and the unique character that comes with an established building? Answering that question will make your property search much more focused.

What Really Drives Condo Prices in Tokyo?

Beyond the age of a building, a few core factors have an outsized impact on the price of any Tokyo condo. Knowing what they are is crucial for figuring out if a listing is a great deal or completely overpriced.

There's one rule that trumps almost all others: proximity to a train station. An apartment that's a five-minute walk from a major station on the JR Yamanote Line will always command a much higher price than a similar one that’s a fifteen-minute walk away. It's just a non-negotiable for most Tokyoites.

Other make-or-break factors include:

- The "Brand" of the Neighborhood: Living in central wards like Chiyoda, Chuo, and Minato comes with a hefty price tag. Areas further out offer a better balance of convenience and value.

- Building Management and Amenities: A well-run building with a proactive management association (kanri kumiai) is worth its weight in gold. Features like a concierge, gym, or robust auto-lock security also add to both the value and the monthly fees.

- The View and Floor Level: Don't underestimate the power of a good view. An apartment with a clear shot of the Tokyo Tower or Mount Fuji can add a serious premium, as can simply being on a higher floor.

Getting a handle on these basics is the perfect starting point. When you're ready to get into the nitty-gritty, our complete guide on how to https://www.mapdomo.com/blog/buy-condo-in-tokyo walks you through every step of the process.

Getting the Financing Right for Your Tokyo Property

Finding the perfect Tokyo condo for sale is a huge milestone, but it’s really only half the journey. The other, often more daunting, half is getting your financing sorted out. This is where things can feel a bit overwhelming, especially if you're a foreign national. But trust me, with the right information and a bit of prep work, it’s completely doable.

The single biggest factor that will shape your financing journey is your residency status in Japan. It dictates which banks will talk to you, what documents you’ll need, and the kind of loan terms you can expect.

If you have a Permanent Resident (PR) visa, you’re in a great position. Japanese banks will view your application much like they would a Japanese citizen's. This opens the door to the best loan products and some seriously competitive interest rates. Having PR status signals stability to lenders, which makes the whole process run a lot more smoothly.

For those on a work visa or buying from overseas as a non-resident, the path is a bit narrower, but it's by no means a dead end. While some banks may not offer mortgages to non-PR holders, plenty of others do. You just have to be prepared for stricter requirements, like a larger down payment or a slightly higher interest rate. Several major Japanese banks and even some international lenders have departments that specialize in working with foreign buyers.

Your Mortgage Options: Fixed vs. Variable

When you sit down with a lender, the conversation will quickly turn to the type of mortgage you want. In Japan, it really boils down to two main choices: fixed-rate or variable-rate. Each has its own set of pros and cons.

-

Fixed-Rate Mortgage (全期間固定金利, zen-kikan kotei kinri): This is the "set it and forget it" option. Your interest rate is locked in for the entire life of the loan, which can be up to 35 years. The major benefit here is predictability; your monthly payment will never change. If you like to budget with certainty and want to sleep well at night without worrying about interest rate hikes, this is your best bet.

-

Variable-Rate Mortgage (変動金利, hendō kinri): This loan typically starts with a lower interest rate than a fixed-rate mortgage, which means smaller initial payments. However, the rate can change over time based on market conditions. Given Japan's historically low-interest-rate environment, many local buyers choose this option to save money upfront. You just have to be comfortable with the risk that your payments could increase down the line.

Ultimately, this decision comes down to your personal comfort with risk and your long-term financial outlook.

The All-Important Down Payment

In Japan, the down payment is called atamakin (頭金), and it’s a non-negotiable part of the buying process. While you might hear stories of Japanese buyers getting loans with very little money down, that’s not a realistic expectation for foreign nationals.

For Permanent Residents, a down payment of 10% to 20% of the purchase price is the standard. If you’re a non-resident or on a temporary visa, you’ll almost certainly need to bring 20% or more to the table. A hefty atamakin does more than just get your foot in the door—it shows the bank you're financially sound, which can lead to better loan terms and a higher chance of approval.

Pro Tip: Remember that the down payment is just one piece of the upfront cash you'll need. The various closing costs and taxes are paid separately and are not rolled into the mortgage, so you need to have extra funds ready.

Budgeting for the "Hidden" Costs

This is where many first-time buyers get caught off guard. The final purchase price of the condo is not the final amount you’ll pay. A collection of taxes, fees, and commissions can add up fast. A good rule of thumb is to set aside an additional 6% to 8% of the property’s price just for these closing costs.

Here’s a quick rundown of what to expect:

| Fee or Tax | What It Is | How Much to Budget |

|---|---|---|

| Brokerage Commission | The fee you pay your real estate agent for their hard work. | 3% of the property price + ¥60,000 + consumption tax |

| Stamp Duty | A tax on the official sales contract, based on the property's value. | ¥10,000 to ¥60,000 for a typical condo |

| Registration Tax | A tax to legally register your ownership and the mortgage. | Around 1.5% to 2% of the property's assessed value |

| Property Acquisition Tax | A one-time tax from the local government that arrives a few months after you move in. | Roughly 3% to 4% of the property’s official valuation |

Accounting for these expenses from day one will save you from any last-minute financial scrambling. When you know exactly what to expect, the process of buying your Tokyo condo for sale becomes a far more confident and enjoyable experience.

Navigating the Purchase and Legal Process

So, you’ve found the one. After countless viewings, you’ve pinpointed the perfect Tokyo condo for sale, and now it's time to make it yours. This is where the process shifts from searching to signing, and while it involves a lot of paperwork, each step is there to protect you.

The first move is to formally express your interest by submitting an "Application to Purchase" (kounyu moshikomisho). This isn't a binding contract, but rather a letter of intent. It tells the seller you're serious and lays out your proposed price, your ideal closing date, and any other conditions you might have. Think of it as officially tossing your hat in the ring.

If the seller likes your offer, your agent will get to work preparing one of the most critical documents in the entire process.

Understanding the Explanation of Important Matters

Before you sign anything that legally commits you, Japanese law requires your agent to present and explain a document called the "Explanation of Important Matters" (juyo jiko setsumeisho). This is an incredibly detailed report that covers absolutely everything you need to know about the condo and the building itself.

It can be a bit overwhelming, but this is your chance to do your due diligence. This document is packed with vital information, including:

- The legal status of the property title and ownership.

- Local zoning laws and any building restrictions that apply.

- The financial health of the building's management association.

- Any known defects or issues with the condo or common areas.

- Building rules, like those for renovations, pets, or how you can use the property.

Your agent, who must be a licensed real estate professional, will sit down and go through this with you, page by page. Don't be shy—this is the time to ask every question you have. For a head start, check out our guide on the key questions to ask before buying a home in Japan.

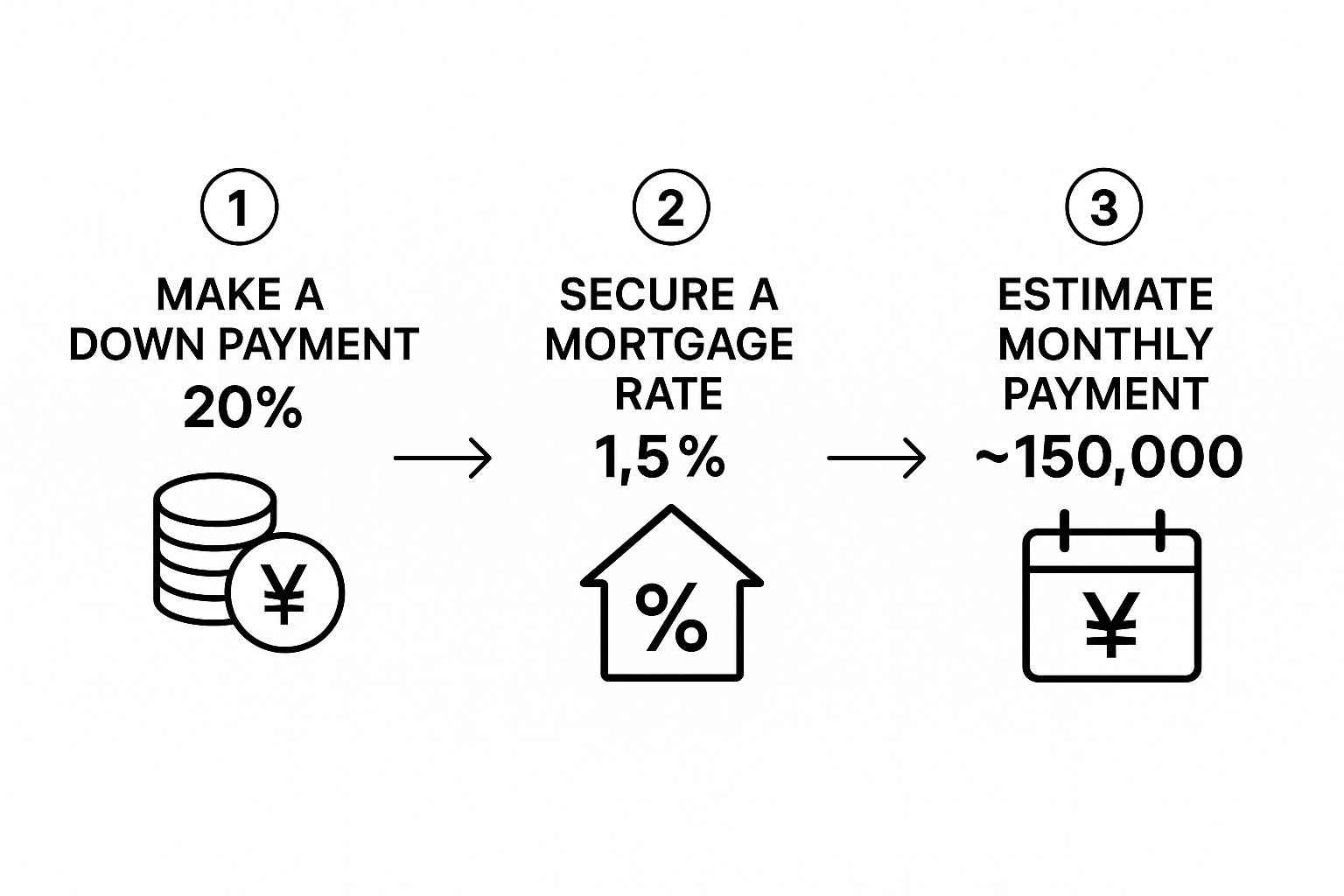

The financial side of things usually kicks into high gear around this stage, as illustrated below.

This gives you a clear picture of how your down payment, mortgage, and monthly payments will all come together in a real-world purchase.

The Role of the Judicial Scrivener

In many Western countries, you’d hire your own lawyer for a property deal. In Japan, the system is a bit different. The key legal expert here is the Judicial Scrivener (shiho shoshi). They act as a neutral third party whose sole job is to ensure the property title is transferred correctly and legally.

The scrivener handles the critical final steps:

- They verify the identities of both you and the seller.

- They confirm all money has been paid as agreed.

- They prepare and file all the official paperwork to register the new ownership with the Legal Affairs Bureau.

Having a scrivener involved provides a crucial layer of security, making sure the entire transfer is official and by the book. Their fee is typically split between the buyer and seller.

The legal process in Japan is incredibly methodical. The whole system is built on checks and balances, with professionals like the judicial scrivener ensuring every detail is handled correctly. Your job is to stay engaged, ask questions, and make sure you understand every document you sign.

The Purchase and Sale Agreement

Once you’ve gone through the "Explanation of Important Matters" and are ready to commit, the next step is signing the formal "Purchase and Sale Agreement" (baibai keiyakusho). This is the big one—the legally binding contract. At this point, you'll also pay the deposit, which is usually 10% to 20% of the purchase price.

This agreement locks in all the terms of the sale. Pay close attention to clauses covering things like defect liability, financing contingencies, and what happens if you need to cancel. Backing out after signing this contract almost always means you'll lose your deposit.

Diving into Due Diligence and Property Inspections

Once the legal documents are out of the way, your attention can pivot to the property itself. This is where the real detective work begins. Performing thorough due diligence on any Tokyo condo for sale is far more than a simple box-ticking exercise—it’s the single most important step you'll take to protect your investment.

This is your opportunity to see beyond the beautifully staged furniture and fresh coat of paint. You need to understand the true state of both the apartment and the entire building. A sharp eye now can save you a world of financial headaches and stress down the line.

The All-Important Long-Term Repair Plan

One of the first documents you should ask for is the building’s long-term repair plan, known in Japanese as the choki shuzen keikaku (長期修繕計画). This isn't just a list of suggestions; it's a detailed, multi-decade schedule that lays out all planned maintenance and major repairs for the whole building.

Think of it as the building's financial and structural roadmap. It tells you exactly when major projects—like waterproofing the roof, repainting the exterior, or overhauling the elevators—are scheduled to happen. All of this work is paid for from a repair reserve fund (shuzen tsumitatekin), which every owner contributes to monthly.

What you're hoping to see is a proactive, well-funded plan. If the reserve fund is looking thin or major repairs are already overdue, that’s a massive red flag. It could signal a looming "special assessment"—a large, one-time payment demanded from all owners to cover urgent work.

A healthy repair reserve and a realistic long-term plan are the hallmarks of a well-run building. It shows the owners' association is serious about protecting the property's value.

What to Look for During the Physical Inspection

While you can always hire a professional home inspector, most buyers in Japan conduct the initial walkthrough themselves. When you’re viewing the property, you need to actively look for problems beyond the surface-level cosmetics.

Here’s a practical checklist to run through inside the unit:

- Plumbing & Water Pressure: Don't be shy. Turn on every faucet, including the shower. You're looking for strong, steady pressure. Peek under all the sinks and around the base of the toilet for any tell-tale signs of leaks.

- Signs of Water Damage: Scan the ceilings and walls very carefully, paying close attention to corners and the areas around window frames. Any weird discoloration, bubbling paint, or a faint musty smell is a warning sign of water issues, past or present.

- Electrical System: Take note of the number and placement of outlets. Many older buildings simply don't have enough for modern tech needs. Flip the light switches on and off to make sure everything is in working order.

- Windows & Doors: Open and close every window and interior door. Do they move smoothly, or do they stick and scrape? Check the seals around the windows for drafts or signs of cracking and decay.

Getting hands-on like this helps you build a much clearer picture of what you’re actually buying. It takes your search for a Tokyo condo for sale from a collection of online photos to a real, tangible assessment.

Getting to Grips with Building Management Rules

Finally, your due diligence isn’t complete until you’ve reviewed the building's management rules, or kanri kiyaku. These rules dictate everyday life in the building and can seriously affect your lifestyle and future plans.

Every building has its own unique set of regulations, so never assume anything. For instance, some condos have incredibly strict policies on renovations. You might need to get formal approval from the management association just to change the flooring.

Other critical rules to investigate are:

- Pet Policies: Are pets even allowed? If they are, check for restrictions on size, number, or even specific breeds.

- Garbage Disposal: Japan's trash rules are famously complex. You need to understand the building's specific system for separation, collection days, and disposal locations.

- Use of Common Areas: Find out the rules for using balconies, rooftop terraces, or any shared community spaces.

These aren't just polite suggestions; they are legally binding on all residents. Making sure they align with your lifestyle is every bit as crucial as checking the plumbing. This comprehensive approach is what ensures the condo you choose is a sound investment and a comfortable home for years to come.

Closing the Deal and Taking Ownership

You’ve done the hard work—the market research, securing a loan, and all the due diligence. Now for the exciting part: closing the deal and officially taking ownership of your new Tokyo condo.

This final step is surprisingly straightforward and incredibly organized, usually revolving around a single, pivotal meeting.

The Final Settlement Meeting

This isn't just a casual handover. It’s a formal gathering of all the key players: you, the seller, both real estate agents, and a judicial scrivener who acts as the legal quarterback for the entire process. The meeting is almost always held at your bank, since that’s where the final, significant payment will be sent from.

During this meeting, the scrivener will painstakingly verify everyone's identity and give all the documents a final review. Think of them as the gatekeeper ensuring every 'i' is dotted and 't' is crossed. Once they give the green light, you’ll authorize your bank to wire the remaining purchase balance directly to the seller’s account.

At the same time, you'll settle up any other outstanding costs. This usually includes:

- The second half of your real estate agent's commission.

- The judicial scrivener's fee for their legal services.

- Prorated amounts for annual property taxes and monthly building fees.

Once the seller confirms the money has landed in their account, the financial side of the deal is officially done. The focus then immediately shifts to the legal transfer of ownership.

This final meeting is the culmination of weeks, if not months, of effort. It’s a very formal and systematic process, which is actually a good thing. The Japanese system is designed to protect both the buyer and seller by making sure every detail is handled perfectly.

Securing the Title and Getting the Keys

With payment confirmed, the judicial scrivener doesn’t waste a moment. They will immediately take all the required paperwork to the local Legal Affairs Bureau to file the official change of ownership. This registration is what legally makes you the new owner of the condo.

It's a critical piece of the puzzle, and you can learn more about why it's so important in our guide on how to verify property ownership.

You won't walk out with the new title deed (called a kenri-sho) that day. The official registration takes about a week or two to process, and the document will be mailed to you after that.

But here’s the best part: you get the keys right then and there. The key handover typically happens at the end of the settlement meeting. It’s a fantastic moment—the symbolic and practical point where the property truly becomes yours.

A smooth closing is crucial, especially in a market with such dramatic shifts. For example, in March 2025, the average price for new apartments in greater Tokyo spiked to an eye-watering 104.85 million yen, a 37.5% jump from the previous year, before it began to cool off. The used condo market, however, has been a model of consistency, with prices in Tokyo's 23 wards climbing 28.3% year-over-year by April 2025. You can dig into these trends and discover more insights about Tokyo property prices on Japan Property.

Your Post-Purchase Checklist

Getting the keys is just the beginning of your journey as a homeowner. Here are a few essential things you'll need to do to get settled in.

- Register at the Ward Office: This is a big one. You have 14 days to register your new address at the local ward office (kuyakusho or shiyakusho). It’s a legal requirement for everyone living in Japan.

- Set Up Utilities: You’ll need to get the electricity, gas, and water services transferred into your name. Your real estate agent can usually give you the contact numbers to make this process much easier.

- Understand Your Ongoing Costs: Get familiar with the monthly building management fees (kanrihi) and the contribution to the repair reserve fund (shuzen tsumitatekin). These are almost always paid by automatic bank transfer, so you’ll want to get that set up quickly.

- Prepare for Property Taxes: Don’t forget about the annual fixed asset tax (kotei shisan zei). The city will send you a bill, which is typically paid in four installments throughout the year.

Your Top Questions About Buying a Tokyo Condo, Answered

If you’re diving into the search for a Tokyo condo for sale, you've probably got a long list of questions. That’s completely normal, especially if you're a first-timer or an expat navigating a new system. Let's clear up some of the most common uncertainties people have—getting these answers straight will make the whole journey feel a lot less intimidating.

"Can I Even Get a Mortgage as a Foreigner?"

This is hands-down the number one question I hear, and the answer is a resounding yes. But, the path to getting that loan really depends on your visa status.

If you have a Permanent Resident (PR) visa, congratulations. For banking purposes, you're essentially on the same footing as a Japanese citizen. This unlocks the best mortgage products and the most competitive interest rates because lenders see you as a long-term fixture.

Don't have PR? No problem. If you're here on a work visa, you still have solid options. Major banks like SMBC Prestia have entire divisions dedicated to foreign clients, and some regional banks are also very welcoming. Just be ready for a few extra hurdles. Lenders will likely ask for:

- A larger down payment, often in the 20% range.

- Solid proof of your income and employment stability here in Japan.

- In some cases, they might feel more comfortable if you're married to a Japanese national or someone with PR.

Now, buying from overseas without any residency status is the toughest route, but it’s not impossible. It just means you’ll need a significant cash down payment and will have to work with specialized international lenders who understand this kind of complex transaction.

"What Else Am I Paying for Each Month Besides the Mortgage?"

Your mortgage is the biggest piece of the pie, but it’s not the whole pie. Owning a condo in Tokyo comes with a few standard monthly and annual fees that you absolutely must bake into your budget from the start.

Think of these as your contribution to keeping the building running smoothly and saving for its future.

- Building Management Fee (kanrihi): This is for the day-to-day stuff. It covers cleaning the lobby and hallways, paying the concierge, keeping the lights on in common areas, and maintaining the landscaping.

- Repair Reserve Fund Fee (shuzen tsumitatekin): This is a forced savings plan for the entire building. Every month, you and your neighbors chip in to a fund that will eventually pay for huge projects like replacing the elevators, re-tiling the exterior, or fixing the roof.

- Annual Fixed Asset Tax (kotei shisan zei): Your yearly property tax, paid to the city. You'll get one bill annually, but it's usually broken down into four quarterly payments.

As a rule of thumb, for a typical two-bedroom condo in central Tokyo, you can expect the combined kanrihi and shuzen tsumitatekin to fall somewhere between ¥25,000 and ¥45,000 per month. This number can swing quite a bit depending on how fancy the building's amenities are, its age, and its total number of units.

"Do I Need to Get a Professional Home Inspection?"

This is a great question because the answer is so different from what you might be used to back home. In places like the US or UK, an inspection is a critical, almost mandatory, part of the deal. Here in Japan, it’s much less common for condo purchases.

Why? The system has built-in protections. The seller is legally required to disclose any known defects, and the real estate agent provides an incredibly detailed document called the "Explanation of Important Matters." This covers everything from the building's history to neighborhood regulations.

Most Japanese buyers simply do their own careful visual check and trust the provided documents. But that doesn’t mean you can't hire an inspector. If it gives you peace of mind, go for it. A pro can spot things you might miss, like subtle signs of plumbing issues, insulation quality, or electrical quirks.

My advice? If you’re looking at an older building—especially one built before the 1981 kyu-taishin earthquake-resistance standards—getting an inspection is a very smart move.

"Realistically, How Long is This Whole Process Going to Take?"

From the moment you start your serious search to the day you're holding the keys, you're generally looking at a timeframe of about two to four months.

Of course, some parts move faster than others. Here’s a rough breakdown of how it usually plays out:

| Stage | Estimated Time |

|---|---|

| Property Search & Viewings | 1-2 months |

| Loan Pre-Approval | 1-2 weeks |

| Offer & Negotiation | 1 week |

| Contract Signing | 1 week after offer acceptance |

| Final Loan Approval | 2-4 weeks after contract |

| Closing & Handover | 1-2 weeks after final approval |

The property search is the biggest wild card—it can take a week or six months, depending on how specific your needs are and what's on the market. Once you find "the one," however, the rest of the process unfolds at a fairly predictable pace. The single best thing you can do to speed things up is to have all your financial paperwork organized and ready to go for the bank.

Ready to turn these answers into action? At mapdomo, we make exploring the Japanese real estate market simple and intuitive. Our interactive maps and powerful filters help you discover everything from modern city condos to traditional countryside homes. Start your search and find your perfect Japanese property today at https://mapdomo.com.