How to Buy Property in Japan: Complete Buyer’s Guide 2024

Looking to buy property in Japan? Discover expert tips on legal steps, financing options, and finding your ideal home as a foreigner. Start your journey today!

Posted by

Yes, foreigners can absolutely buy property in Japan. This often comes as a surprise, but there are virtually no restrictions. Whether you’re on a tourist visa or a long-term resident, you have the same legal rights as a Japanese citizen when it comes to purchasing freehold land and buildings. This incredibly open policy makes it one of the most accessible real estate markets in Asia for international buyers.

Why Now Is the Time to Buy Property in Japan

Unlike many countries that put up barriers like special visas or residency requirements, Japan rolls out the welcome mat. You can legally own a home here without being a resident or citizen, which is a game-changer for many investors. For a deeper dive, check out our guide on buying a house in Japan as a foreigner.

But this welcoming legal framework is just the starting point. Right now, a perfect storm of economic and social trends is creating a truly compelling window of opportunity for anyone looking to invest.

Favorable Economic Conditions

After years of being relatively flat, Japan's real estate market is on a serious upswing. As of January 1, 2025, the nationwide average land price jumped by 2.7%—the fourth year in a row of growth and the biggest increase since 1991.

The market itself is valued at around USD 436 billion in 2024 and is on track to hit USD 557 billion by 2033. The numbers clearly point toward solid growth potential.

Several key factors are driving this positive climate:

- A Weak Yen: For those with foreign currency, the current exchange rate is a huge advantage. Your money simply goes further, effectively giving you a significant discount on the purchase price.

- Low Interest Rates: Japan has maintained its famous ultra-low interest rates for years. For buyers who can secure local financing, this can make a world of difference in affordability.

- Tourism Recovery: With tourism roaring back to life, the demand for short-term rentals and vacation properties is exploding, especially in hotspots like Tokyo, Osaka, and Kyoto.

This unique combination of legal accessibility, a strengthening market, and favorable currency exchange creates a window of opportunity for international buyers that is hard to ignore.

To give you a clearer picture, here’s a quick look at the key indicators shaping the market today.

Key Market Indicators for Property Buyers in Japan

| Metric | Recent Trend or Statistic |

|---|---|

| Nationwide Land Price | +2.7% as of Jan 1, 2025 (strongest growth since 1991) |

| Market Valuation (2024) | Approximately USD 436 billion |

| Projected Market (2033) | Expected to reach USD 557 billion |

| Interest Rate Environment | Remains historically low, benefiting borrowers |

| Currency Exchange | Yen is weak against major currencies like USD and EUR |

| Tourism Sector | Experiencing a strong post-pandemic recovery, boosting rental demand |

These figures underscore why so many international investors are turning their attention to Japan right now. The fundamentals are strong, and the conditions are ripe for investment.

A Market of Diverse Opportunities

The great thing about Japan is that "buying property" doesn't just mean a sleek, modern condo in Tokyo. The market is incredibly diverse, with something for almost any budget or lifestyle goal. You can find everything from bustling urban apartments to sprawling, serene countryside estates.

One of the most talked-about opportunities is the rise of akiya, or vacant homes. Due to an aging population and shifting demographics, Japan has millions of these unoccupied houses. Many are sold for unbelievably low prices, making them fantastic projects for anyone interested in renovation or simply looking for a quiet retreat in a rural community.

This guide will walk you through every practical step—from figuring out what kind of property fits your goals to navigating the paperwork and finally closing the deal. Understanding these market dynamics is the crucial first step toward making a smart, confident investment.

How to Find and Choose Your Japanese Home

So, you're ready to start the hunt. Your search for the perfect Japanese home begins by getting a feel for the unique property landscape here. Whether you're picturing a sleek city condo, a classic detached house, or maybe even a charming old home ripe with potential, knowing where to look and what to look for is everything when you decide to buy property in Japan.

For most people, the journey starts with a good Japanese real estate agent, or fudousan-ya (不動産屋). Finding one who has experience with foreign buyers can make a world of difference. They’re not just showing you properties; they’re your guide, helping you decipher listings and navigate the little quirks of the local market.

Decoding Japanese Property Listings

When you first start browsing, you’ll run into some unique Japanese terminology. The most common one you'll see is the layout description, like 1LDK or 3LDK. It's actually a pretty simple shorthand:

- L is for Living Room

- D is for Dining Room

- K is for Kitchen

- The number tells you how many separate bedrooms there are.

A 2LDK is simply a home with two bedrooms plus a combined living, dining, and kitchen area. And if you see the word "mansion" (マンション), don't picture a sprawling estate. It’s just the common term for a modern concrete condominium building, the kind you see everywhere in cities.

The Tokyo condo market, for example, is incredibly dynamic. In March 2025, new apartment prices in the greater Tokyo area shot up to an average of 104.85 million yen—a massive 37.5% jump from the previous year. But just a month later, the average price dropped back to around 90 million yen because a different mix of properties hit the market. To get a real sense of these trends, it's worth reading up on Japanese property price fluctuations here.

The Property Viewing or Naiken

Once you've got a shortlist, it's time for the viewing, known as a naiken (内見). This is your chance to see past the pretty pictures and get a real sense of the property's condition. This isn't just about checking room sizes; it's about doing your homework.

During a naiken, focus on the details that really matter for long-term value and livability.

- Earthquake Resistance: This is a big one. Ask about the building's earthquake standards. Any property built after 1981 had to meet the stricter shin-taishin (新耐震) standards, which is a critical safety factor you shouldn't overlook.

- Proximity to Public Transport: In Japan, how close you are to a train or subway station is a massive driver of property value. Listings will usually state the walk time, like "8-minute walk to Shibuya Station," but you should always walk it yourself to see what it's really like.

- Sunlight and Orientation: South-facing properties are highly sought after because they get the best natural light. Check the orientation and try to imagine how the sun will move through the home during the day.

Here's a key takeaway: In Japan, walkability and transit access aren't just nice-to-haves—they are fundamental drivers of market value and rental demand. A home that's just five minutes closer to a major station can command a significantly higher price.

Akiya Hunting and Unique Opportunities

Beyond the typical market, Japan has become famous for its akiya (空き家), or vacant homes. You'll often find these in more rural areas, and they can sometimes be bought for incredibly low prices. While the thought of a super cheap—or even free—house is tempting, it comes with strings attached.

Many akiya need a lot of work, and just tracking down the owner can be a complicated process. But for someone willing to put in the effort, fixing up an akiya can be a hugely rewarding project and offer a unique lifestyle away from the city hustle. Platforms like mapdomo are great resources for filtering through thousands of listings, including some of these unique akiya opportunities across Japan.

Ultimately, choosing your home comes down to balancing your budget, your lifestyle, and your investment goals. Whether you’re pulled to the energy of a city or the quiet of the countryside, a methodical search and a thorough viewing process will lead you to a place that truly feels like home.

Navigating the Legal Process and Paperwork

At first glance, the Japanese legal system can seem intimidating with its reputation for precision and detail. This is especially true when you're looking to buy property in Japan. But here’s the reality I’ve seen time and again: with the right professional help, the process is remarkably secure and clear. You won't be left to figure out the maze of documents on your own.

The key person you'll come to rely on is the Judicial Scrivener, or Shihō-shoshi (司法書士). Think of them as the specialized legal professional who orchestrates the most critical part of the entire deal—the official title transfer. Their job is to prepare and file all the registration documents with the Legal Affairs Bureau, making sure the property becomes legally and indisputably yours.

For anyone buying from overseas, their expertise is a lifesaver. They handle the nitty-gritty of title searches, verify who the real owner is, and check for any outstanding liens or claims against the property. Their involvement isn't just a formality; it's a fundamental layer of security that makes the whole transaction transparent and legally sound.

Understanding Key Legal Documents

Before you ever see a final contract, your real estate agent will walk you through a critical document: the Explanation of Important Matters, or Jūyō Jikō Setsumeisho (重要事項説明書). This isn't the sales contract itself. Instead, it’s an incredibly detailed disclosure report that covers every conceivable aspect of the property.

It’s a legal requirement for a licensed agent to verbally explain every single point in this document to you. It contains everything you need to know, including:

- Ownership Details: Confirms the currently registered owner.

- Property Specifications: Lays out the exact boundaries, building materials, and age of the structure.

- Zoning and Regulations: Details any restrictions on land use, like whether you can rebuild or run a business from the location.

- Easements and Encumbrances: Discloses any third-party rights-of-way or liens attached to the property.

Pay close attention during this meeting. It is your absolute best chance to ask probing questions and get clarity on exactly what you’re buying before you're financially committed.

The Explanation of Important Matters is your shield against surprises. Never, ever sign the final purchase agreement until you have thoroughly reviewed and understood this document with your agent or a trusted translator.

Once you’re satisfied with the disclosures, you’ll move on to the formal purchase and sale agreement. This is the legally binding contract that locks in the price, payment schedule, and the date you’ll officially take ownership.

Essential Paperwork for Foreign Buyers

As a foreign buyer, especially if you're not a resident of Japan, you’ll need to prepare a few specific documents. The process is very accessible, but a little bit of prep work goes a long way.

One of the most crucial items is an affidavit. Since non-residents don't have a Japanese certificate of residence (jūminhyō), you need a sworn affidavit to confirm your identity and home address. You'll need to get this prepared in your home country at your local embassy or through a notary public.

Your typical paperwork checklist will look something like this:

- Proof of Identity: Your passport is the standard here.

- Affidavit: This notarized document from your home country confirms your full name, address, and signature.

- Personal Seal (Optional but Recommended): While a signature is perfectly legal, having a registered personal seal (inkan) can sometimes make administrative processes a bit smoother down the line.

Post-Purchase Legal Requirements

Once the deal is closed and the keys are in your hand, there’s one last, simple step required for all foreign buyers. You need to file a formal notification with the Minister of Finance, which is done via the Bank of Japan.

This notification has to be submitted within 20 days of acquiring the property. It sounds far more complex and official than it actually is—in reality, it’s just a reporting formality. In nearly every case, your judicial scrivener handles this for you as part of their standard service. It's a straightforward form that simply registers the change in asset ownership to a foreign national, keeping you in full compliance with Japanese law.

Financing Your Purchase and Managing Costs

Getting your finances in order is arguably the biggest challenge when you set out to buy property in Japan, especially if you're not a resident. The path to securing funds here is worlds away from what you might be used to back home. Nail this down early, and you'll save yourself a world of headaches.

First, let's get one thing straight: getting a mortgage from a major Japanese bank as a non-resident is next to impossible. Most local lenders won't even look at your application unless you have permanent residency (eijuken) or are married to a Japanese national. This is a hard-and-fast rule that stops many international buyers in their tracks.

So, where does that leave you? The most direct route is a cash purchase. If you have the capital ready to go, the entire process becomes drastically simpler. You sidestep all the lender approvals and financial hoops, making you a much more attractive buyer. For most foreign buyers, this is the reality.

Exploring Alternative Financing Avenues

If buying with cash isn't on the table, you still have a few paths to explore, though they're often trickier. Some international banks with a Japanese presence, like UOB or HSBC, occasionally offer loans to foreigners, but don't count on it. Their requirements are incredibly stringent and often limited to very specific, high-value properties.

Another option is to try and get a loan from a bank in your home country. This can be tough, as most banks are wary of lending against an overseas asset they can't easily value or repossess. Still, it’s worth a shot, especially if you have a long-standing, solid relationship with your bank.

The single most important takeaway here is to have your financing completely sorted out before you even think about making an offer. Walking into a negotiation knowing exactly how you're going to pay gives you serious leverage and proves you're not a time-waster.

Budgeting Beyond the Purchase Price

The price on the property listing is just your starting point. A classic rookie mistake is forgetting about all the extra fees and taxes, which can easily tack on an additional 6% to 8% of the purchase price to your final bill.

This isn't pocket change, so let's break down what those costs typically cover.

Estimated Closing Costs for a Japanese Property

When you're finalizing your budget, it's crucial to account for the various closing costs. These are non-negotiable and are usually paid in cash on the closing day. The table below provides a quick rundown of what to expect.

| Cost Item | Estimated Percentage or Amount | What It Covers |

|---|---|---|

| Agent Commission | 3% of sale price + ¥60,000 (+ tax) | Your real estate agent's fee for their services. This is a standard industry rate. |

| Stamp Duty (Inshi-zei) | ¥10,000 – ¥60,000 | A tax on the official purchase agreement document, with the amount tied to the property's price. |

| Registration & License Tax (Toroku Menkyo Zei) | 1.5% – 2% of property’s assessed value | The government tax for officially registering the property ownership transfer in your name. |

| Judicial Scrivener Fees | ¥100,000 – ¥200,000 | Payment to the legal professional (Shihō-shoshi) who handles all the legal paperwork for the title transfer. |

| Property Acquisition Tax (Fudosan Shutoku Zei) | 3% – 4% of property’s assessed value | A one-time tax from the local prefectural government. The bill for this will arrive a few months after you've closed. |

Being aware of these figures from the start helps you build a realistic budget and prevents any nasty financial surprises that could derail the deal at the last minute. For a deeper dive into what you can expect to pay, it helps to understand Japan's current housing prices and regional differences.

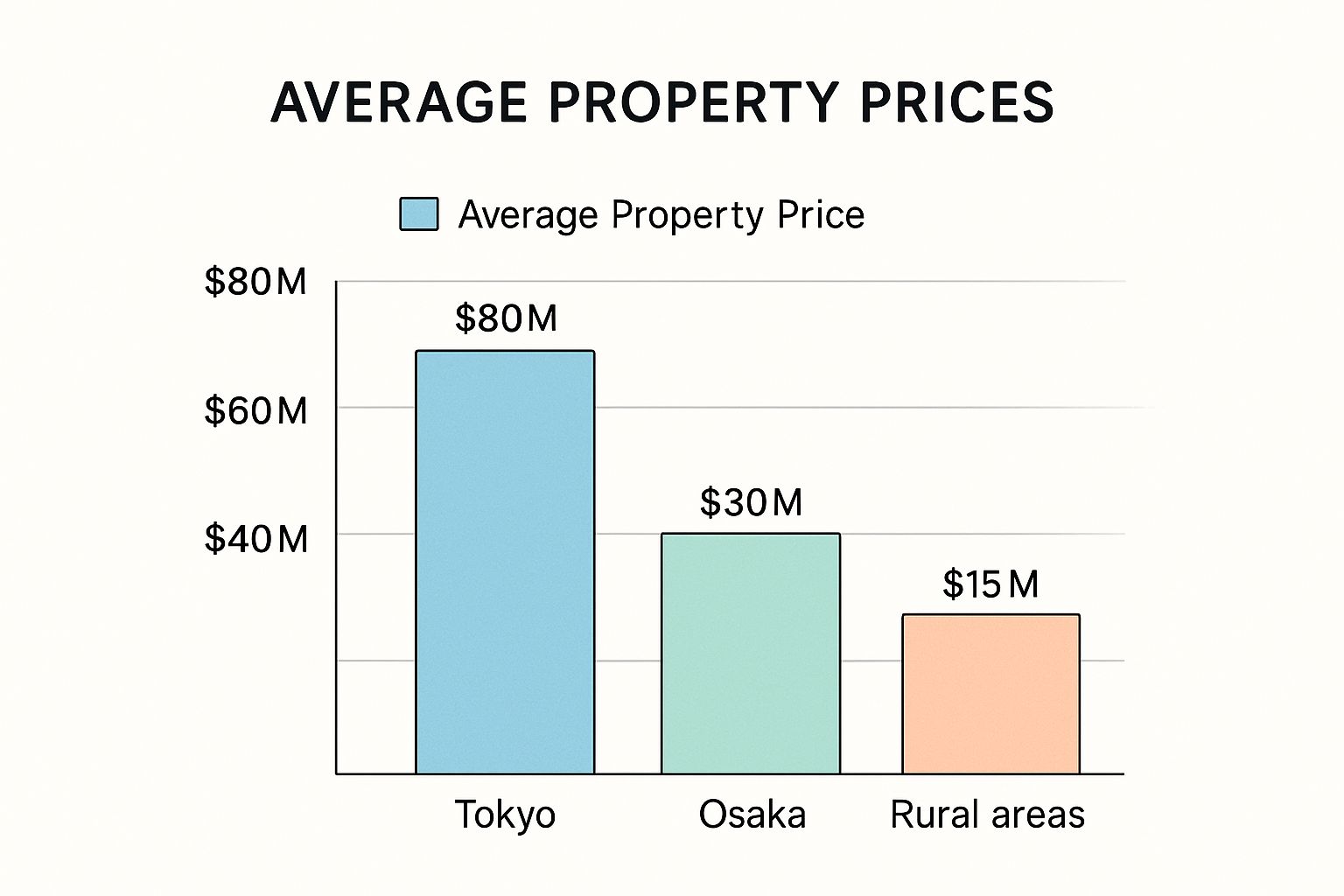

As you can see, the price gap between regions is massive. A property in Tokyo can easily cost twice as much as a similar one in Osaka and more than five times what you'd pay in a rural area. This really drives home how important it is to match your budget to your target location from day one.

Getting to the Finish Line: Closing the Deal and What Comes Next

You’ve done the hard work—you’ve navigated the viewings, secured your financing, and waded through all the critical legal paperwork. The final hurdle to buy property in Japan is the closing meeting. It’s a surprisingly efficient and formal process that marks the official transfer of ownership. This is where everything comes together.

This meeting usually takes place at your bank. You, the seller, both real estate agents, and the Judicial Scrivener will all gather in one room. Here, you'll transfer the final payment for the property and settle up all remaining closing costs, like agent commissions and registration taxes. As soon as the bank confirms the funds have moved, the Judicial Scrivener is out the door and heading straight to the Legal Affairs Bureau to file the title registration.

In about a week or two, you’ll receive the official Title Certificate, known as the Kenrisho (権利証). This document is the ironclad proof of your ownership. Congratulations, the property is now legally yours.

Your New Financial Commitments

Getting the keys is just the beginning. Your responsibilities as a property owner in Japan start immediately, and it’s crucial to understand the ongoing costs to avoid any unwelcome surprises. These aren't optional—they are legal obligations that come with your new asset.

The biggest recurring expense you'll face is the annual property tax. Every single property owner in Japan pays this, and the bill typically arrives in one notice from your local municipal office.

Here's the breakdown:

- Fixed Asset Tax (Kotei Shisan Zei - 固定資産税): This is the main property tax, calculated from the assessed value of your property (which is almost always lower than what you paid for it). The standard tax rate is 1.4% of this value.

- City Planning Tax (Toshi Keikaku Zei - 都市計画税): If your property is in a designated urban planning zone—which most city properties are—you'll also pay this tax. The rate is usually around 0.3% of the assessed value.

When you add them up, you should budget for roughly 1.7% of your property’s assessed value each year. The tax bill is usually sent around April or May, and you can pay it all at once or in four quarterly installments.

Owning property is a long-term commitment. Factoring in these recurring taxes, along with potential maintenance and fees, is just as important as budgeting for the initial purchase price.

Special Costs for Condominium Owners

If you bought a condominium or what the Japanese call a "mansion," you've got a couple of extra monthly fees to think about. These are non-negotiable payments that go to the building's management association (kanri-kumiai) to keep the property well-maintained for everyone.

- Building Management Fees (Kanri-hi - 管理費): This covers the day-to-day running of the place—think cleaning the lobby and hallways, maintaining the elevators, and landscaping.

- Repair Reserve Fund (Shuzen Tsumitatekin - 修繕積立金): This is your mandatory contribution to a long-term savings fund. It’s used for major, expensive repairs like replacing the roof, repainting the exterior, or seismic retrofitting, which typically happen every 10 to 15 years.

The Bigger Picture of Property Ownership

Understanding these responsibilities is especially important right now. Japan is dealing with some unique demographic shifts, particularly what’s known as the '2025 Problem,' where a rapidly aging population is making a big impact on the housing market.

As of April 2024, the number of vacant homes, or akiya, hit a staggering 9 million units, pushing the national vacancy rate to 13.8%. You can dig deeper into Japan's housing market trends and challenges to understand the context. This backdrop really underscores the importance of choosing a property with long-term value and being fully prepared for all the duties of ownership.

Common Questions From Foreign Buyers

Jumping into a new property market is bound to bring up a lot of questions. When you're a foreigner looking to buy in Japan, a few key concerns seem to pop up more than others. We've heard them all, so we’ve put together some straight, practical answers to help you move forward with confidence.

Let's clear up some of the biggest uncertainties you might have.

Are There Any Real Restrictions on Foreigners?

This is usually the first thing people ask, and the answer is refreshingly simple: no. When it comes to buying freehold land or a building in Japan, there are no legal restrictions based on your nationality or visa status. You have the same property rights as a Japanese citizen.

The only extra step is a small piece of paperwork. After the sale closes, you have 20 days to file a notification with the Minister of Finance (via the Bank of Japan). This is just a formality, not some kind of hurdle, and your judicial scrivener almost always takes care of this for you as part of their closing services.

Can I Get a Mortgage From a Japanese Bank?

This is where things get tricky. For anyone who isn't a resident, securing a loan from a Japanese bank is extremely difficult. The vast majority of Japan's major banks won't even consider an application unless you have permanent residency (eijuken) or are a Japanese national. This is often the single biggest financial hurdle for buyers living abroad.

It's not completely impossible, of course. Some smaller, regional banks might be open to it if you have long-term residency and a stable income here in Japan, but it's certainly not something you should count on.

Your most realistic financing options will be buying with cash, getting a loan from a bank in your home country that lends against overseas assets, or finding a specialized international lender.

What Ongoing Costs Should I Expect?

The purchase price is just the first number. Owning property in Japan means budgeting for several annual costs that will continue for as long as you own the home.

- Fixed Asset Tax (Kotei Shisan Zei): This is the main annual property tax, usually calculated at 1.4% of the property's assessed value (which is always quite a bit lower than its market price).

- City Planning Tax (Toshi Keikaku Zei): If your home is located in a designated urban promotion zone, you'll also pay this tax. It’s typically around 0.3% of the assessed value.

- Management Fees (Kanri-hi): For apartments and condos, this is a monthly fee that covers the upkeep of all the common areas—think lobbies, elevators, hallways, and landscaping.

- Repair Reserve Fund (Shuzen Tsumitatekin): Another monthly fee for condo owners. This money goes into a long-term savings fund for major future repairs, like replacing the roof or large-scale structural work.

Thinking through these obligations from day one is critical. To help you cover all your bases, we put together a list of questions to ask before buying a home in Japan that goes into these financial details and much more.

Does Buying a House Get Me a Visa?

This is a very common misconception. Owning property in Japan, no matter how expensive, does not automatically grant you any kind of visa or residency rights. Your immigration status and your property ownership are two completely separate things.

Now, if you were to buy a property to run a business out of, that could potentially support an application for a Business Manager or Investor visa. But the act of buying the property itself offers no shortcuts for immigration. You still have to apply for a visa through the normal channels, based on your reason for being in Japan (work, family, study, etc.).

What About Renovating an Older Home?

Many buyers from overseas are drawn to older Japanese houses, especially akiya (vacant homes), because of their character and incredibly low prices. But renovations here come with their own unique set of challenges.

Finding skilled carpenters and builders can be a real struggle, especially out in the countryside. On top of that, costs can quickly spiral. You never know what you'll find once you open up the walls, and bringing an old home up to modern earthquake-resistance standards can be a massive undertaking. Always get a thorough inspection and a few realistic renovation quotes before you even think about making an offer.

An old house might look like a steal on paper, but the total investment of time, money, and stress to make it truly livable can be enormous.

Ready to find your perfect Japanese home? At mapdomo, we make discovery easy. Explore thousands of listings across Japan, from modern city apartments to charming countryside akiyas, all on an interactive map. Start your search and find your place in Japan today at https://mapdomo.com.