How to Buy a House in Japan A Foreigner's Guide

Thinking of buying property in Japan? Our guide covers how to buy a house in Japan, from navigating the market and securing loans to legal steps for foreigners.

Posted by

First things first, let's clear up the biggest question on most people's minds: can a foreigner buy a house in Japan? The answer is a resounding yes. There are no residency restrictions, and the legal hoops you need to jump through are the same for everyone, whether you're a Japanese national or from overseas.

Your journey starts with two key things: getting a real feel for the market and getting your money in order.

Your Guide to the Japanese Property Market

Buying a home in Japan is an incredible experience, but it’s a world away from how things are done in many other countries. It’s packed with its own unique rules and cultural quirks.

For instance, while a century-old house might be a prized possession in the West, Japan has a deep-seated preference for new builds. A big reason for this is safety; earthquake resistance standards have been updated so frequently over the years that newer homes just feel more secure.

This "new is better" mindset has a direct impact on property value. The building itself can depreciate incredibly fast—sometimes losing most of its value within 20-30 years. The real long-term value is almost always in the land underneath it. Grasping this concept from the get-go is essential for setting realistic expectations for your investment.

Understanding Current Market Trends

The Japanese real estate market is anything but sleepy. In fact, it's been buzzing with activity, especially in the big cities. Nationwide, average land prices jumped by 2.7% by January 2025, which is the steepest climb we've seen since 1991.

If you're looking at the Tokyo Metropolitan Area, the numbers are even more stark. Residential property prices there shot up by 8.14% year-over-year. For anyone trying to figure out how to buy a house in Japan, these figures really drive home how competitive things are right now.

What does this mean for you? Japan’s real estate market, currently valued around USD 436 billion, is on a clear growth trajectory. This is fueled by a rebound in tourism and a chronic shortage of new housing, creating a dynamic environment for buyers.

The Home-Buying Journey in Japan at a Glance

Getting from "I want to buy a house" to "Here are the keys" can feel like a maze, but it's really just a series of logical steps. To help you visualize the road ahead, I've broken down the core stages. This table gives you a bird's-eye view of the process.

| Stage | Key Action | What You'll Achieve |

|---|---|---|

| Research & Budgeting | Figure out what you need and get pre-approved for a loan. | A solid budget and a clear list of must-haves. |

| Property Search | Partner with a real estate agent and start viewing properties. | A curated shortlist of homes you're serious about. |

| Making an Offer | Submit a non-binding "Letter of Intent" to the seller. | A formal, but not yet final, expression of interest. |

| Due Diligence | Carefully review the "Explanation of Important Matters" document. | A complete understanding of the property's legal fine print. |

| Contract & Closing | Sign the final purchase agreement and transfer the funds. | Official ownership of your new home! |

Each of these stages has its own nuances, which we explore in more detail throughout our complete guide on how to buy property in Japan. Think of this as your foundational map for the exciting journey ahead.

Finding the Right Home in Japan

Alright, you've got your budget sorted and a feel for the market. Now for the exciting part—finding your actual home. Japan offers an incredible range of options, from slick city apartments to charming houses tucked away in the countryside. Each offers a completely different lifestyle, so it’s worth understanding the landscape before you dive in.

The first thing you'll notice is that Japan's housing market has its own unique vocabulary. Getting a handle on these terms is the first step to narrowing your search effectively.

Mansions, Ikkodate, and Akiya Explained

As you start browsing listings, a few key Japanese words will pop up again and again. Knowing what they mean will make your search infinitely easier.

- Manshon (マンション): Don't let the name fool you; this isn't a sprawling mansion. It refers to a modern condominium or apartment, typically in a reinforced concrete building. You'll find these everywhere in urban areas, prized for their convenience and security.

- Ikkodate (一戸建て): This is your classic detached, single-family house. It could be a brand-new build or a much older home, often with a little patch of garden or a parking spot. They're the go-to choice in suburban and rural Japan.

- Akiya (空き家): This term simply means "vacant home." You'll see this a lot, especially in rural areas, as Japan's population shifts. Some of these are available for a steal, but they often come with their own set of challenges.

Speaking of akiya, it’s impossible to ignore Japan’s shifting demographics. The rapidly aging population has created a massive surplus of empty homes. As of April 2024, there were a record 9 million vacant homes nationwide. That’s a vacancy rate of 13.8%—the highest ever recorded.

Many of these are inherited properties that families don't know what to do with. With inheritance registration becoming mandatory in 2024, we expect even more of these to hit the market. If you want to get into the weeds, you can find more insights on the vacant home situation and what it means for buyers.

New Builds Versus Pre-Owned Homes

One of the biggest forks in the road for any buyer here is choosing between a new construction and a pre-owned property. There’s a strong cultural preference in Japan for new homes, and it’s not just about aesthetics—it's heavily tied to safety and building standards.

Earthquake resistance is, of course, a huge deal. Any home built after June 1981 must comply with the shin-taishin (新耐震) earthquake-resistance standards. This is a game-changer, offering vastly better protection during a tremor. For most people, this is a non-negotiable, and it’s a major reason why older homes are often valued so much lower.

A crucial takeaway for any buyer is that in Japan, the building itself is often seen as a depreciating asset, while the land retains or gains value. A wooden house might fully depreciate in as little as 20-25 years, meaning a 30-year-old home's value is almost entirely in its land.

Starting Your Property Search

So, you know the lingo and what you’re looking for. Time to start the hunt. The best approach is usually a mix of your own online research and partnering with a professional.

A real estate agent, known as a fudousan-ya (不動産屋), will be your most important ally. A great agent doesn't just send you listings; they provide local intel, handle the tough negotiations, and walk you through the mountain of paperwork. If your Japanese isn't fluent, finding a bilingual agent is worth its weight in gold.

While your agent works their magic, you can get a great overview of the market on online property portals. Sites like Suumo and Lifull HOME'S are the giants in this space, with enormous databases of listings covering every corner of the country.

What to Look for During a Viewing

Once you've got a shortlist, you'll schedule a viewing, or naiken (内見). This is your chance to see past the polished photos. In older homes especially, keep a sharp eye out for the big stuff: structural integrity, any signs of water damage or pests, and the state of the plumbing and electrical systems.

Don't forget the practicalities of daily life. How long is the walk to the nearest train station, really? Where’s the closest supermarket? If you have kids, what are the local schools like?

Never be afraid to ask questions. Your agent is there to get you answers. A good viewing should leave you with all the information you need to confidently decide how to buy a house in Japan.

Financing Your Purchase and Understanding Costs

This is often the biggest hurdle, especially for foreign buyers. Navigating the financial side of buying a home in Japan isn't overly complicated, but it all comes down to two things: securing a mortgage and being prepared for the extra costs that go way beyond the property's sticker price.

The good news? Yes, foreign residents can absolutely get mortgages from Japanese banks. The reality check, however, is that your eligibility is almost entirely tied to your visa status.

Securing a Home Loan as a Foreign Resident

For most Japanese banks, the gold standard for getting a home loan is Permanent Residency (PR). When you have PR, it signals a long-term commitment to living and working in Japan, which instantly makes you a much lower-risk borrower in their eyes. Without it, things get trickier—though not necessarily impossible.

Some of the big banks might consider applicants on other long-term visas, like a spousal or highly-skilled professional visa. Your chances improve dramatically if you have a stable job with a well-known Japanese company and can show a solid income history. Just be ready for a higher level of scrutiny and potentially less attractive loan terms. For anyone on other visa types or living outside Japan, buying with cash is often the only realistic option.

A crucial piece of advice I give every foreign buyer: start talking to banks before you even start looking at properties. Getting pre-approved isn't just a formality. It gives you a rock-solid budget to work with and instantly makes you a more serious, attractive buyer when you find the right place and are ready to make an offer.

Popular Mortgage Options in Japan

As you start exploring your loan options, you’ll mainly come across a few standard types. The best one for you really depends on your personal finances and how comfortable you are with risk.

- Variable-Rate Loans: These are incredibly popular because they start with super-low interest rates. The catch is that the rate can change during the loan's term, meaning your monthly payments could go up if market rates rise.

- Fixed-Rate Loans: If you value predictability, this is for you. Your interest rate is locked in for a specific period—think 10, 20, or even 35 years—so your payments never change. The trade-off is that the initial rate is usually a bit higher than a variable loan.

- Flat 35 Loan: This is a government-backed, long-term fixed-rate mortgage available through many different banks. It's a favorite for its stability, but there’s a condition: the property itself has to meet certain technical standards for things like energy efficiency and earthquake resistance.

Budgeting Beyond the Purchase Price

The price on the real estate listing is just your starting point. Anyone learning how to buy a house in Japan needs to budget for closing costs, which will typically add an extra 5% to 8% on top of the property price.

Think about it: for a ¥40 million home, that’s another ¥2 million to ¥3.2 million you’ll need to have available in cash. These aren't optional fees; they cover a whole range of taxes and professional services. Planning for them from day one means you won't get any nasty financial surprises right when you're about to get the keys.

Let's look at what these costs actually are. The table below breaks down the main expenses you'll run into.

Estimated Closing Costs for a Japanese Property

The property's sale price is just one part of the equation. This table outlines the typical fees and taxes you'll pay at closing, which are essential for accurate financial planning.

| Cost Item | Estimated Cost | What It Covers |

|---|---|---|

| Agent Commission | 3% of property price + ¥60,000 (+ tax) | The standard fee for your real estate agent's work, from property hunting to final paperwork. |

| Stamp Duty | Varies (e.g., ¥10,000 for ¥10-50M property) | A tax you pay on the official purchase contract. The amount is tiered based on the sale price. |

| Registration Tax | ~2% of the property's assessed value | Known as toroku menkyo zei, this tax covers the legal registration of your ownership title. |

| Property Acquisition Tax | 3% (building) & 1.5% (land) of assessed value | This is a one-time prefectural tax (fudosan shutoku zei) that you'll be billed for 3-6 months after you move in. |

| Judicial Scrivener Fee | ¥100,000 - ¥150,000 | The fee for the shihoshoshi (legal professional) who handles the title transfer and registration process. |

Getting a handle on these numbers is key to building a realistic budget. When you factor them in from the beginning, you can move forward with confidence, knowing exactly what it takes to own your own piece of Japan.

Getting Through the Legal Steps to Ownership

Alright, you've found a place that feels like home and your financing is lined up. Now comes the part that can feel intimidating: the legal process. But don't worry. Buying a house in Japan follows a very structured, well-trodden path designed to protect both you and the seller. It’s meticulous, for sure, but every step is there for a reason—to make sure everything is crystal clear before you get the keys.

Making Your Initial Offer

The first move is to formally show you're serious. You'll do this by submitting a 'kaitsuke shomeisho' (買付証明書), which translates to a Letter of Intent. Think of this not as a binding contract, but as a firm handshake on paper. It tells the seller, "I want to buy your property at this price and under these conditions."

Submitting this letter gets the ball rolling and lets your agent start negotiating in earnest. The best part? It's almost always non-binding. If something unexpected comes up during due diligence or you simply have a change of heart before signing the final contract, you can usually walk away without any penalty.

The Most Important Meeting: Explanation of Important Matters

Before you sign anything that locks you in, you'll attend a meeting for the 'juuyou jikou setsumei' (重要事項説明). This is the "Explanation of Important Matters," and honestly, it's probably the single most critical step in your due diligence. It's a legal requirement, and for good reason.

A licensed real estate professional will sit down with you and go through a detailed document covering every conceivable aspect of the property. We're talking about the nitty-gritty details that matter.

- Who actually owns it? They'll confirm the registered owner and clarify the type of ownership (like freehold vs. leasehold).

- What are the rules? You'll learn about zoning laws, building restrictions, and any specific neighborhood regulations.

- What's the property's condition? This covers shared utilities, property boundaries, and any known defects or issues.

- What are the contract terms? They'll explain the conditions for canceling the deal and what happens to your deposit.

This entire process is designed so there are no surprises later. If your Japanese isn't business-fluent, it's absolutely vital to bring a translator or have a bilingual agent by your side to make sure you understand every single point.

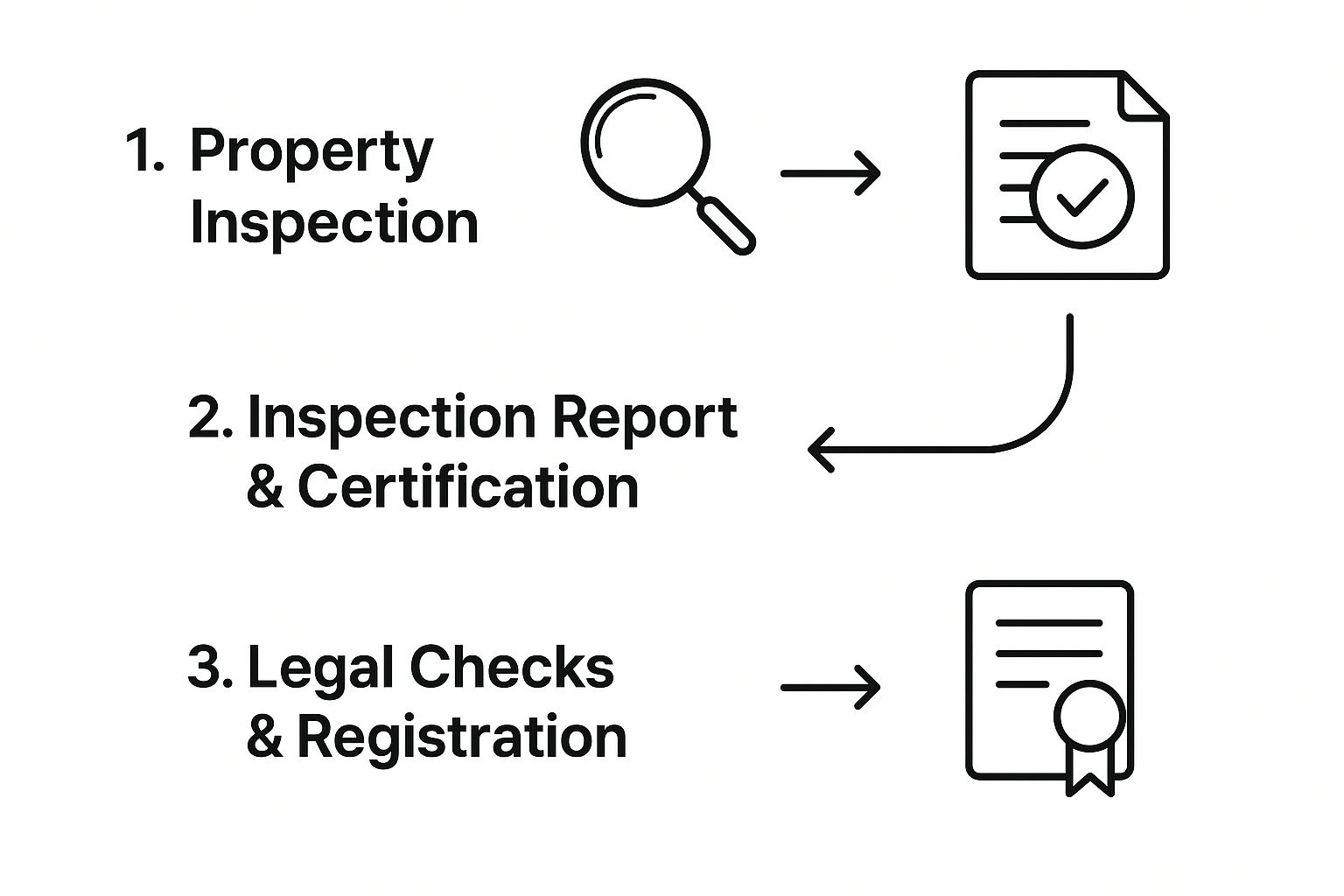

As you can see, the process is sequential. A thorough inspection gives way to comprehensive legal checks before the title is finally and officially registered in your name.

Signing the Dotted Line: The Purchase Agreement

Once you've gone through the Explanation of Important Matters and feel confident about moving forward, it's time to sign the 'baibai keiyakusho' (売買契約書), or the purchase agreement. This is it—the legally binding contract.

When you sign, you'll also pay the deposit, called the 'tetsukekin' (手付金). This is typically 5% to 10% of the home's price and is paid directly to the seller. It serves as your commitment. If you decide to back out for a personal reason after this point, you'll lose that deposit. On the flip side, if the seller pulls out, they are legally required to pay you back double the deposit amount as a penalty.

A Quick Word on Your Personal Seal ('Hanko') In Japan, official documents aren't usually signed with a pen. Instead, people use a personal seal called a 'hanko' (判子). As a foreign buyer, you’ll need to get a seal made and registered to complete the transaction. While an affidavit from your embassy can sometimes work as a substitute, getting your own registered hanko makes the entire process much smoother.

The Final Handover: Closing Day

The final meeting is the closing, or 'kessai' (決済). This usually happens at your bank and brings everyone to the table: you, the seller, both agents, and a very important legal expert called a 'shihoshoshi' (司法書士), or judicial scrivener.

The shihoshoshi is a government-licensed professional whose job is to handle the legal transfer of the property title. They are your safeguard, verifying everyone's identity and all the paperwork before filing the official ownership registration with the Legal Affairs Bureau.

During this meeting, you'll wire the remaining balance of the purchase price to the seller. Once the seller confirms they've received the money and the shihoshoshi has all the signed documents, the deal is done. The seller hands you the keys, and just like that, the property is officially yours.

For a more detailed breakdown of what to expect, you can get additional insights by reading more about the journey of buying a house in Japan on our blog.

What International Buyers Need to Know

Buying property in Japan as a non-Japanese citizen comes with its own set of challenges. While the laws don't discriminate based on nationality, the practical side of things—from getting a loan to understanding the paperwork—can be a different story. Your visa status, Japanese language ability, and awareness of ongoing costs will make all the difference.

Getting a home loan from a Japanese bank is often the biggest hurdle. Your success here hinges almost entirely on your residency status. The magic key is Permanent Residency (PR). If you have it, banks see you as a long-term, stable prospect. Without PR, it’s a much tougher conversation, but not necessarily a deal-breaker if you have a stable job and another long-term visa.

The Language Gap is Real

Don't gloss over the language barrier. Every official document you sign, from the initial offer to the final title registration, will be in Japanese. You might get an English translation for your reference, but legally, only the Japanese version counts.

This is where having the right people on your team becomes non-negotiable. You'll want to find:

- A bilingual real estate agent: They're more than just a translator. A good one can explain the subtle cultural nuances behind a listing, handle delicate negotiations, and make sure nothing gets lost in translation during property viewings.

- A bilingual judicial scrivener (shihoshoshi): This is the legal expert who manages the property title transfer. You absolutely need someone who can walk you through the closing process in a language you understand, so you know exactly what you’re signing.

Before you jump into the search, get your questions ready. We've put together a helpful list of key questions to ask before buying a home in Japan to get you started.

Life After You Get the Keys: Your Responsibilities

Your job isn’t done once the keys are in your hand. As a foreign owner, you have a few specific obligations to keep in mind for the long haul.

First up is a simple piece of paperwork. You are required to file a notification of acquisition with the Bank of Japan within 20 days of taking ownership. It sounds official, but it's really just a formality. Your agent or scrivener will have the form ready for you.

You'll also need to budget for annual property taxes, called 'kotei shisan zei' (Fixed Asset Tax). The bill comes every year from your local municipal office. Make sure you understand how the tax is calculated so there are no surprises.

It’s also a smart move to think about inheritance. Should you pass away while owning the property, Japanese inheritance laws could come into play. It's well worth a conversation with a legal expert to see how this might impact your estate and ensure your wishes are carried out.

Finally, keep an eye on the market, especially in major cities like Tokyo. Things can change fast. For instance, in March 2025, the average price for a new apartment in the greater Tokyo area shot up to around 104.85 million yen—a staggering 37.5% increase from the year before. At the same time, the market for existing condos saw a healthy 28.3% year-over-year price growth. These numbers show just how competitive and dynamic the market can be, so staying informed is crucial for making a good investment. You can find more insights into Tokyo's dynamic property market trends to help shape your strategy.

Your Top Questions About Buying a Home in Japan, Answered

Even with a roadmap in hand, buying a house in Japan can feel like navigating a new city—full of exciting turns but also a few unfamiliar street signs. It's totally normal to have questions.

Let's clear up some of the most common uncertainties we hear from buyers, especially those new to the Japanese market. Getting these details straight is the key to moving forward with confidence.

Do I Need to Be a Resident or Citizen to Buy Property?

Let’s get the big one out of the way first. No, you absolutely do not need to be a resident, have a visa, or be a citizen to buy property in Japan. The law is refreshingly straightforward: the process of acquiring a title is the same for everyone, regardless of nationality.

The real hurdle for non-residents isn't legal—it's financial. Most Japanese banks simply won't offer a home loan to someone without long-term residency and a local work history. This means if you’re buying from abroad, you’ll almost certainly need to pay with cash or arrange financing from a bank in your home country.

There is one small piece of paperwork after the sale: you'll need to notify the Bank of Japan of your purchase. It's just a formality, and your real estate agent will walk you through it.

What's the Real Difference Between Freehold and Leasehold?

This is a critical distinction that impacts the very nature of your investment. In Japan, you'll run into two main types of property ownership.

- Freehold (所有権, shoyuken): This is what most people think of when they imagine owning a home. You own the building and the land it sits on, forever. You can sell it, renovate it, or pass it down to your kids without asking for permission. It's the gold standard.

- Leasehold (借地権, shakuchiken): With this, you own the building, but you're effectively renting the land underneath for a very long time (think decades). You'll pay a monthly ground rent to the landowner.

Leasehold properties can look like a bargain because the upfront cost is much lower. But that comes with strings attached. You often can't sell or make major changes without the landowner’s approval, and you build zero equity in the land itself—which is arguably the most valuable part of the deal. Always, always confirm the ownership type before getting serious about a property.

Think of it this way: In Japan, buildings lose value over time, much like a car. The land is the core asset that holds or increases in value. Freehold gives you full control over that asset.

How Do Property Taxes Work in Japan?

Once you own a home, you’ll have two main annual taxes to pay. Your local municipal office will send you a bill for these each year, so it's a cost you'll want to budget for.

The first is the Fixed Asset Tax (固定資産税, kotei shisan zei). The standard rate is 1.4% of the property's officially assessed value. The key here is that this assessed value is usually much, much lower than what you actually paid for the property.

The second is the City Planning Tax (都市計画税, toshi keikaku zei). This only applies if your property is in a designated urban development area. The rate is typically around 0.3% of the assessed value. Your local government re-evaluates property values every three years, so your tax bill can change slightly over time.

What Should I Expect from an Older Japanese Home?

The condition of older homes here can be a real mixed bag. Unlike in the West where “old” often means charming, in Japan, buildings are generally seen as depreciating assets with a limited lifespan.

The most important date to know is 1981. This is when the government introduced the 'shin-taishin' (新耐震) earthquake resistance standards. Any home built before this benchmark may need serious (and expensive) structural work to be considered safe by today's measures.

Beyond that, many older homes, especially vacant ones known as 'akiya,' might need a complete overhaul of their plumbing, wiring, and insulation.

But don't write them off! A well-maintained older home can be a fantastic deal, especially since you're really buying the valuable land it sits on. The single most important thing you can do is hire a professional for a thorough building inspection. It’s the only way to get an unbiased look at the home’s true condition and avoid any costly surprises down the road.

Ready to turn your dream of owning a home in Japan into a reality? At mapdomo, we make it easy to discover properties all across the country, from bustling city apartments to charming countryside akiyas. Our interactive map and powerful search filters help you find the perfect home that fits your life and budget. Start your search and explore over 100,000 listings at https://mapdomo.com today.