How to Buy Property in Japan A Practical Guide

Learn how to buy property in Japan with this practical guide. We cover financing, finding agents, legal steps, and navigating the Japanese real estate market.

Posted by

Thinking about owning a home in Japan? You might be surprised to learn it's a lot more straightforward than you'd expect. Japan has no legal restrictions on foreigners buying property, which opens the door for anyone to own a piece of this beautiful country.

Whether you're picturing a sleek Tokyo apartment or a quiet home in the countryside, the path is open. But, as with any major purchase, it's a process. You’ll need to navigate finding the right place, sorting out your finances, making an offer, and finally, handling the legal paperwork with a judicial scrivener. Getting a handle on the costs involved from the get-go is the key to making it a smooth journey.

First Things First: Understanding the Upfront Costs

The price on the listing is just the starting point. When you're budgeting, you need to account for a number of additional costs that pop up during the transaction. I always tell my clients to plan for these to be somewhere in the ballpark of 6-8% of the purchase price.

Knowing about these fees upfront means no nasty surprises when it's time to sign the papers. It lets you walk into the process with your eyes wide open and your finances in order.

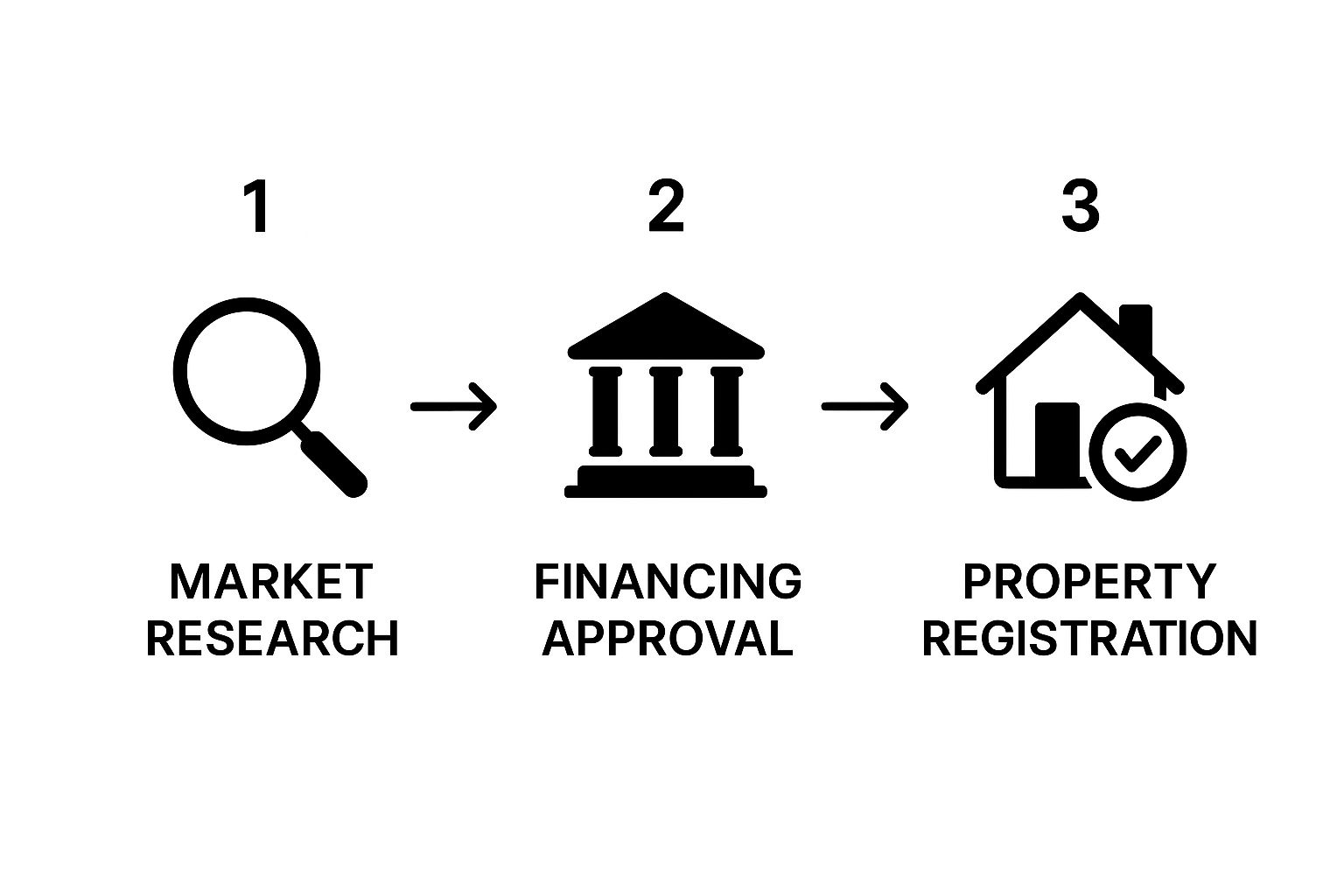

This graphic gives a great overview of the journey, showing how it all fits together from the initial search to getting the keys. It’s a good reminder that buying property is a structured process, not a one-off event.

To give you a clearer picture, here's a breakdown of the typical one-time fees and taxes you can expect to pay during the acquisition process.

Estimated Upfront Costs When Buying Property in Japan

| Cost Item | Typical Percentage of Purchase Price | Brief Description |

|---|---|---|

| Real Estate Agent Commission | 3% of price + ¥60,000 (+ tax) | Your agent's fee for finding the property and facilitating the deal. This is often the largest single expense. |

| Deposit (Tetsukekin) | 10-20% | A good-faith payment made to the seller when you sign the purchase and sale agreement. |

| Stamp Duty | Varies by price | A government tax on the official sales contract. The amount depends on the property's value. |

| Registration & License Tax | Approx. 1.5-2% | A tax for legally registering the property transfer and mortgage under your name. |

| Real Estate Acquisition Tax | Approx. 1.5-3% | A one-time local tax on acquiring property, usually billed a few months after the purchase. |

These are the main players, but keep in mind that smaller costs like legal fees for the judicial scrivener and prorated property taxes will also be part of the final calculation.

A Quick Word on Financing

For most foreign buyers, getting a mortgage in Japan can be the biggest hurdle. Japanese banks are generally quite conservative and tend to require permanent residency, a Japanese spouse, or at the very least, a long-term, stable employment history in Japan.

It’s not impossible to get a loan without these, but it is certainly a challenge.

My best advice is to sort out your financing early. Don't fall in love with a property only to find out you can't get the loan. Talk to banks before you even start seriously looking—it will give you a realistic idea of what you can actually afford.

The Japanese market has its own rhythm. For example, condos in central Tokyo have recently been averaging around ¥110 million (roughly $700,000 USD), a reflection of the strong demand in urban centers. Once you find a place, you’ll submit an offer and sign a contract, usually paying a 10% deposit.

Beyond the upfront costs, remember there are ongoing expenses. The annual fixed asset tax, for instance, is typically around 1.4% of the property's assessed value. Navigating this process successfully is all about understanding these distinct steps.

For a complete walkthrough of the entire journey, from the first search to the final signature, have a look at our comprehensive guide on how to buy property in Japan.

Getting a Feel for the Japanese Property Market

Before you even think about scrolling through property listings, it’s really important to get a handle on the unique landscape of Japan’s real estate market. It’s a tale of two completely different stories playing out at the same time, and where you fit in depends entirely on your goals.

On one hand, you have the major urban centers like Tokyo, which are in the middle of a serious price boom. It's a seller's market, driven by a perfect storm of factors that make city living highly desirable.

Then, in sharp contrast, you have rural and suburban areas dealing with a growing number of vacant homes, known as 'akiya'. This creates a market with a massive spectrum of possibilities, from a sleek, high-end city condo to a charming countryside house you can get for next to nothing.

The Urban Boom: A Look at City Prices

If you’re looking at places like Tokyo, Osaka, or Fukuoka, you’ll notice property values are on a steady upward climb. This isn't just a bubble; it's a surge fueled by solid economic and social trends.

- A Weaker Yen: For anyone buying with foreign currency, the weaker yen has been a game-changer. It makes Japanese real estate significantly more affordable than it was just a few years ago, effectively giving you a discount and drawing in a lot of international investment.

- Tourism's Big Comeback: As tourists have flooded back into Japan, so has the demand for short-term rentals and vacation homes. This has put a lot of upward pressure on prices in popular city and resort destinations.

- Not Enough to Go Around: In the most sought-after neighborhoods of major cities, there's a genuine shortage of new, high-quality condos. When demand outstrips supply, prices naturally go up.

The numbers really tell the story here. Japan’s nationwide land price recently saw an annual increase of about 2.7%—the fourth year in a row of gains and the biggest jump since 1991.

In Tokyo, the residential property price index shot up by 8.14% year-over-year. Even more dramatic, new condo prices in the greater Tokyo area hit a historic high, jumping a staggering 37.5% in a single year before cooling off slightly. If you want to dig deeper into the data, you can discover more insights about Japan's property market dynamics.

The 'Akiya' Phenomenon: Opportunity in the Countryside

While the cities are booming, a very different picture is emerging in regional Japan. The country's aging and shrinking population has led to a massive inventory of vacant houses.

We're talking about an estimated 9 million empty homes across the country, which is nearly 13.8% of Japan's entire housing stock. Many of these properties, the 'akiya', are in rural towns and suburbs that younger generations have left behind for jobs in the city.

For buyers on a tighter budget or anyone dreaming of a quiet life away from the hustle, akiya can be an unbelievable opportunity. These homes are often sold for incredibly low prices—some are even given away for free—with the understanding that the new owner will invest in fixing them up.

Of course, buying an akiya isn’t without its challenges. They almost always need significant repairs. Plus, navigating the purchase process with a small-town real estate agent is a world away from dealing with a big firm in Tokyo. It's a path that requires more legwork and a hands-on approach, but the payoff can be huge.

So, What Does This Mean for Your Search?

Understanding this split market is the key to focusing your property search. The right place for you depends entirely on what you want to achieve.

Looking for an investment with good potential for growth and rental income? You should be zeroing in on prime locations within Tokyo, Osaka, or another growing city. The sweet spot is usually near a major train station, with modern amenities that appeal to both Japanese and international tenants.

Hoping to find an affordable family home or a passion project? This is where exploring smaller cities or rural prefectures can pay off big time. An akiya could be the perfect blank canvas for your dream home, as long as you're ready to roll up your sleeves and get to work on renovations.

Once you recognize these big-picture trends, you can move beyond just browsing listings. You can start building a real strategy, targeting specific areas, and finding the opportunities that truly line up with your vision for owning a home in Japan.

Assembling Your Professional Team

Trying to buy a property in Japan all by yourself is a recipe for disaster. It’s like trying to navigate Tokyo's subway system during rush hour without a map—you might get somewhere eventually, but it'll be stressful, confusing, and you'll probably make some expensive mistakes along the way.

The secret to a smooth and secure purchase is surrounding yourself with the right people. This isn't just for convenience; it's about protecting your investment in a market that has its own very specific set of rules.

Your first and most critical partner is a bilingual real estate agent. This person isn’t just showing you properties. They're your guide, your negotiator, and your cultural interpreter, all rolled into one. A great agent who has experience with foreign buyers will know what you don't know and will bridge the language and cultural gaps that can easily kill a deal.

Finding the Right Real Estate Agent

Let's be clear: not all agents are equipped to handle international buyers. You need someone with a proven track record of helping people just like you. When you’re interviewing potential agents, be direct.

- "How many foreign clients did you close deals for last year?" This tells you about their recent, hands-on experience.

- "Could you connect me with a few of your past clients?" There’s nothing more valuable than hearing from someone who’s already walked this path.

- "What’s your process for the Explanation of Important Matters for non-Japanese speakers?" How they answer this question about a key legal document shows how seriously they take client comprehension.

A good agent doesn't just translate; they make sure you understand the implications of what you're signing. Since every official contract will be in Japanese, their ability to explain dense legal-ese in plain language is absolutely essential.

The Crucial Role of the Judicial Scrivener

Once you've found a place and the seller has accepted your offer, a new expert steps in: the judicial scrivener (shiho shoshi). This is a specialized legal professional who handles the official registration of the property transfer. In Japan, lawyers don't typically manage real estate closings. That's the scrivener's job.

Think of the judicial scrivener as the official keeper of the record. Their role is to verify everyone's identity, check all the paperwork, and legally register the new title in your name at the Legal Affairs Bureau. They are the ones who make the transaction official and legally binding.

Your real estate agent will almost certainly have a judicial scrivener they work with regularly. While you technically could find your own, it's usually much easier to go with their recommendation. They have an established workflow, which keeps things moving. The scrivener’s fee is a standard closing cost you’ll need to budget for.

Do You Need a Tax Accountant?

This one isn't always necessary, but a tax accountant (zeirishi) can be a huge help, especially if you're buying an investment property. The Japanese property tax system has its quirks, and a good accountant can provide advice that saves you money and headaches down the road.

For instance, they can clarify your annual fixed asset tax obligations and help you plan for capital gains tax if you ever sell. If you’re a non-resident planning to earn rental income, a tax accountant is pretty much non-negotiable. They’ll make sure you’re filing correctly with the Japanese tax authorities and can often spot deductions you’d never find on your own.

Putting together this team—agent, scrivener, and maybe a tax accountant—might seem like a lot of work upfront, but it’s the bedrock of a successful purchase. Each person has a specific job to do, and together they protect your interests, turning a confusing process into a clear, manageable path to owning your piece of Japan.

From Property Search to Purchase Offer

With your professional team in place, you’re ready for the exciting part: the property hunt. This is where your vision for a home in Japan starts becoming a reality. Knowing where to look—and how to look—is what separates a frustrating search from a successful one.

Your search will almost certainly begin online, but think of the major property portals as just the starting point. They're great for getting a feel for the market, but your agent is your key to unlocking the full picture, including exclusive listings that never hit the public websites.

Mastering the Property Search

At first glance, Japanese property listings can feel a bit like trying to crack a code. They're dense with information, but much of it uses local terminology. For example, you’ll see layouts described with acronyms like "1LDK," which simply means one bedroom plus a combined living, dining, and kitchen area.

Look past the photos and focus on the hard data: the building’s age and its construction materials. This is critically important in Japan. Any building constructed after the 1981 shin-taishin (new earthquake resistance) standards were implemented is a solid baseline. Even better are those built after 2000, as they often meet even more rigorous requirements.

Your agent is your interpreter here. They’ll help you translate the jargon and, more importantly, read between the lines to spot potential red flags before you waste time on a viewing. This initial filtering is absolutely essential.

The Importance of Property Viewings

Once you have a shortlist, it’s time for the 'naiken' (内見), or property viewing. This is your chance to see if the reality matches the photos. I can't stress this enough: pictures can be incredibly misleading, and there's no substitute for walking through a property yourself.

When you're there, try to look past the staging and decor. I always tell my clients to check for the little things—subtle signs of water damage near windows, the condition of the fixtures, and the overall upkeep of the common areas.

And don't forget, you're buying the neighborhood, not just the apartment.

- Get a Feel for the Vibe: Walk around the block at different times of the day. Is it peaceful in the evening? How busy is the street during the morning rush?

- Check for Conveniences: How far is the nearest supermarket? The train station? Are there parks, clinics, or good cafes nearby?

- Look to the Future: Ask your agent if they know of any major construction projects planned for the area. That beautiful view could be at risk.

A viewing is your opportunity to gather intelligence. Don't be afraid to ask direct questions about repair history, the seller's reason for moving, or average utility costs. A good agent will help you dig for the details that aren't in the brochure.

This is especially true in a city like Tokyo. The character and property values can change dramatically from one ward to the next. If you plan to buy a condo in Tokyo, this on-the-ground research is non-negotiable.

Making an Offer with a Letter of Intent

Found the perfect place? It's time to make your move. In Japan, the first formal step is submitting a 'kounyuu moushikomisho' (購入申込書), which is essentially a Letter of Intent (LOI). This is a non-binding document that tells the seller you're serious.

Your LOI is what gets the conversation started. It will state your proposed price, your preferred closing timeline, and any other conditions you might have.

Submitting the LOI quickly gives you a real advantage. Sellers often review offers in the order they're received, and having your financing pre-approved makes your offer incredibly compelling. It shows you’re ready and able to close the deal.

From there, your agent takes over, negotiating with the seller on your behalf. This back-and-forth usually takes a few days to a week. Once you reach an agreement, you’re ready to move to the formal contract, bringing you one giant step closer to owning your home in Japan.

Finalizing the Contract and Closing the Deal

Alright, you've navigated the negotiations and your offer has been accepted. Now comes the most critical part of the journey: making it all legally binding. This isn't just a handshake and a signature; buying property in Japan involves a highly structured process designed to protect everyone involved.

This entire phase hinges on two major events that usually happen back-to-back in the same meeting: the Explanation of Important Matters and the signing of the formal contract. Your agent and a legal professional called a judicial scrivener will guide you through every step.

The Explanation of Important Matters (Juuyou Jikou Setsumei)

Before a single signature hits paper, Japanese law requires a licensed real estate agent to sit down with you for an ‘Explanation of Important Matters’ (juuyou jikou setsumei). This isn't just a quick overview. It’s an exhaustive, clause-by-clause review of a lengthy document covering absolutely everything about the property. Think of it as the ultimate due diligence report, delivered in person.

Your agent will walk you through the specifics, including:

- Legal registration details and official property boundaries.

- Local zoning laws that might impact any future plans for renovation or rebuilding.

- Information on shared utilities, especially important for condos or shared-wall homes.

- Any existing easements (like a neighbor's right to cross a part of your land).

- For condos, a deep dive into the building management rules, monthly fees, and repair fund status.

- The exact conditions under which the contract can be canceled.

This is your prime opportunity to get crystal clear on everything. Since the document is in Japanese, a good agent is worth their weight in gold here, ensuring you grasp every detail.

Don't rush this. The whole point of the juuyou jikou setsumei is to make sure there are no nasty surprises down the road. If you're unsure about a shared fence, a strange clause about a nearby construction project, or anything else, now is the time to speak up.

Signing the Sales and Purchase Agreement (Baibai Keiyakusho)

Once you're completely satisfied and all your questions have been answered, you'll move on to signing the formal Sales and Purchase Agreement (baibai keiyakusho). This is the contract that locks in all the terms you've agreed to, from the final price to the handover date.

At this point, you'll also pay the deposit, known as 'tetsukekin' (手付金). This is a substantial payment, usually 10% of the purchase price, that goes directly to the seller. In Japan, this isn't typically held in a third-party escrow account; it’s a direct payment that signals your firm commitment.

This deposit acts as a security measure for both sides. It secures the property for you, and it also establishes a financial penalty if either party pulls out of the deal for a reason not covered in the contract.

The Final Settlement and Handover

The finish line is the closing meeting, or the final settlement. This usually happens at your bank a few weeks after signing the contract. It’s a formal affair attended by you, the seller, both real estate agents, and the judicial scrivener who handles the legal paperwork.

Here’s how it all comes together:

- Final Payment: You’ll wire the remaining balance of the purchase price to the seller. If you’re using a mortgage, your bank will handle this transfer on the spot.

- Document Exchange: The seller hands over all the documents needed for the title transfer to the judicial scrivener.

- Registration: With documents in hand, the scrivener immediately heads to the local Legal Affairs Bureau to officially register you as the new owner. This happens the same day.

Once the seller confirms the funds have landed in their account and the scrivener is off to file the paperwork, the deal is officially done. The seller will give you the keys, and the property is yours.

A few weeks later, you’ll receive your official title deed, the ‘kenri sho’ (権利証), which is the ultimate proof of your ownership. That's it—you've successfully bought a property in Japan

So You Have the Keys… What Now? Managing Your New Japanese Property

Getting the keys to your new home in Japan is an incredible feeling, but the journey doesn't end there. In many ways, it's just beginning. Now, the real work of being a property owner kicks in, and it comes with a whole new set of responsibilities.

Your first practical task is getting the lights on and the water running. Thankfully, setting up utilities like electricity, gas, and water is usually a painless process. Your real estate agent should be able to give you the contact details for the local providers, and you’ll find that many of them have online sign-up forms or English-language support.

The Deal With Ongoing Condo Fees

If you bought a condominium (or what many of us call an apartment), you're going to get very familiar with two specific monthly fees. These aren't optional—they are a core part of owning a property in a shared building in Japan and are absolutely vital for keeping the building safe and maintaining its value.

You’ll see these on your monthly statements:

- Kanrihi (管理費): Think of this as the monthly building management fee. It covers all the day-to-day operational costs—things like cleaning the common areas, paying for electricity in the hallways, keeping the landscaping neat, and the salary for the building manager (kanrinin).

- Shuuzen Tsumitatekin (修繕積立金): This is your contribution to the building's long-term repair fund. This is the money that gets saved up for the big-ticket items down the road, like replacing the roof, repainting the entire exterior, or upgrading the elevators. These projects are usually planned years in advance.

A well-run building will have a healthy repair fund, which gives you peace of mind that you won't get hit with a sudden, massive bill when a major repair is needed. You should have seen the status of this fund in the property documents, but now it becomes a real-life part of your monthly budget.

Getting Ready for Annual Property Taxes

As a property owner anywhere in the world, you’ve got to pay taxes, and Japan is no different. The annual property tax here is levied by the local government where your home is located, and it's collectively known as kotei shisan zei.

This tax is actually made up of two distinct parts:

- Fixed Asset Tax: This is the main one, with a standard rate of 1.4% of the property's assessed value.

- City Planning Tax: You'll also pay this additional tax, usually around 0.3%, if your property is located within a designated city planning area.

You’ll typically get the tax bill once a year, around April or May, with the option to pay it all at once or in four quarterly installments. It’s a predictable expense, so the best strategy is to set aside a little money for it each month.

Don't panic when you see those percentages. The "assessed value" used for the tax calculation is set by the government and is always much, much lower than the market price you actually paid. This makes the effective tax you pay far more reasonable than it first appears.

A Word for Property Investors

If you bought this property as an investment, your focus immediately shifts to finding tenants and managing the rental. This is where a professional property management company (fudousan kanri gaisha) is worth its weight in gold, especially if you’re living outside of Japan.

A good management company will handle everything—from marketing the property and screening potential tenants to collecting rent, dealing with maintenance requests, and keeping you compliant with local regulations.

For investors, the numbers are everything. While Tokyo's market is famously stable, you can expect average rental yields to be around 3.4%. If you’re looking for higher returns, cities like Osaka and Sapporo often perform better, offering yields closer to 4.5% and 5%, respectively.

The good news? Japan has incredibly high occupancy rates. In Tokyo’s central wards, for instance, vacancy rates often stay below 5%, highlighting just how stable the rental market is. For a deeper dive, it's worth checking out these investment trends and market statistics.

Post-Purchase Annual Cost Obligations

To make things clearer, here’s a quick rundown of the recurring annual expenses you'll need to budget for as a property owner in Japan. These are the costs that continue long after the initial purchase is complete.

| Expense Type | Typical Rate / Amount | Notes |

|---|---|---|

| Fixed Asset Tax | 1.4% of assessed value | The primary annual property tax levied by the municipality. |

| City Planning Tax | 0.3% of assessed value | Applicable only if the property is in a designated city planning zone. |

| Building Management Fee (Kanrihi) | Varies by building | Monthly fee for condos/apartments covering daily operational costs. |

| Repair Reserve Fund (Shuuzen Tsumitatekin) | Varies by building | Monthly contribution to a fund for major future repairs and renovations. |

| Homeowners' Insurance | Varies by policy | Covers fire, earthquake (optional but recommended), and other damage. |

Staying on top of these financial obligations is the final, crucial piece of the puzzle. Whether this property is your new home or a long-term investment, managing it effectively ensures it remains a source of pride and security for many years to come.

Common Questions About Buying Property in Japan

Diving into Japan's property market for the first time will naturally spark a ton of questions. Getting straight answers is the best way to feel confident about your decisions, so let's tackle some of the most common things people ask when they're starting out.

Do I Need a Visa to Buy Property in Japan?

This is easily the question I hear the most, and the answer is a pleasant surprise for many: No, you don't need a specific visa or even residency status to buy property in Japan. The market is incredibly open, allowing anyone, regardless of nationality, to purchase and own freehold property.

The crucial distinction, however, is that owning a home here doesn't automatically give you the right to live in it. To reside in Japan long-term, you'll still need to secure the appropriate visa through the standard channels, whether that's for work, marriage, or another valid reason.

How Hard Is It for a Foreigner to Get a Mortgage?

This is where things can get a bit tricky. Securing a home loan as a non-resident is probably the biggest hurdle you'll face. Japanese banks are known for being quite conservative, and their lending criteria for foreign nationals are pretty strict.

Generally, to be considered a good candidate for a loan from a major Japanese bank, you’ll need at least one of these:

- Permanent Residency (PR) status in Japan.

- A Japanese spouse who can serve as your guarantor.

- A stable, long-term employment history with a company in Japan.

Some international banks with a presence in Japan might be more flexible, but they often compensate for the perceived risk by requiring a much larger down payment—sometimes as high as 40-50% of the purchase price. My best advice? Start talking to banks and mortgage brokers very early on to see where you stand.

Shinchiku vs. Chuuko: What's the Real Difference?

You'll see these two terms everywhere: 'shinchiku' (新築) for brand-new homes and 'chuuko' (中古) for pre-owned properties. They represent two very different approaches to homeownership.

A 'shinchiku' home gives you that "new car smell" feeling. You get modern designs, the latest earthquake-resistance technology, and zero immediate maintenance worries. The trade-off is depreciation. Just like a new car, a new home's value takes its biggest hit in the first few years.

On the other hand, a 'chuuko' property is usually more affordable and often sits in a more mature, established neighborhood. Its value has likely already stabilized, so you won't see that sharp initial drop. The catch is that it might need some work and may not be built to the latest codes, which could mean higher upkeep costs down the line. To help you evaluate older homes, it's worth checking out these essential questions to ask before buying a home in Japan.

Ultimately, this choice comes down to your personal priorities. A new build buys you peace of mind. A used home can offer better value and character, but you need to be ready for potential maintenance.

Are There Reporting Requirements for Foreigners After Buying?

Yes, there's one key piece of paperwork for non-resident buyers. Under Japan’s Foreign Exchange and Foreign Trade Act, if you don't live in Japan, you are legally required to notify the government of your real estate purchase.

You have to file a report with the Minister of Finance (via the Bank of Japan) within 20 days of closing the deal. This might sound intimidating, but it's really just a standard administrative step. Your real estate agent or the judicial scrivener who handles the title transfer will know exactly what to do and can help you get the form filled out and submitted on time.

Ready to turn your dream of owning a home in Japan into a reality? Start your search on mapdomo, where you can explore thousands of properties across the country, from modern city apartments to traditional countryside akiyas. Find your perfect Japanese home today.