Japan Houses for Sale A Complete Buyer's Guide

Thinking about Japan houses for sale? Our guide breaks down the buying process, property types, legal steps, and top regions for your investment.

Posted by

The thought of sifting through listings for Japan houses for sale can feel like chasing a dream, but it's a goal far more grounded in reality than most people think. Japan’s property market is a fascinating mix of ancient tradition and modern investment, creating some truly compelling opportunities for buyers from all over the world.

Why Buying a House in Japan Is an Achievable Dream

When you imagine owning a home in Japan, what comes to mind? Serene temples, futuristic cityscapes, or a quiet house in the countryside? That vision isn't just a fantasy. It’s a very real possibility, thanks to a property market that’s surprisingly welcoming to international buyers. Unlike many other countries, Japan has no restrictions on foreigners owning freehold land or property.

Think of this guide as your personal orientation. We're here to cut through the complexity and give you a clear, step-by-step roadmap for your journey.

From Urban Apartments to Rural Retreats

One of the best parts about the Japanese market is the sheer variety of homes available. Your search could lead you to a sleek, modern apartment—what the locals call a ‘mansion’—in a Tokyo high-rise, or it could end at a charming traditional wooden farmhouse, known as a ‘kominka,’ tucked away in a quiet village.

Each type of property offers a completely different lifestyle and investment angle:

- Modern ‘Mansion’ Apartments: These are perfect if you value convenience, security, and being close to all the action in cities like Tokyo or Osaka.

- Detached ‘Ikkodate’ Houses: Ideal for families who need more space and maybe a small garden. You’ll typically find these in suburban areas.

- Traditional ‘Kominka’ Homes: For those seeking a unique cultural experience and a slower pace of life, these historic homes in scenic rural spots are incredible finds.

The Unique Opportunity of 'Akiya'

You may have heard whispers about 'akiya'—the growing number of vacant or abandoned homes across Japan. It's a fascinating phenomenon. These properties are often sold for incredibly low prices, making them a fantastic entry point for savvy buyers, especially those with a knack for renovation. They certainly come with their own set of challenges, but they also offer a rare chance to own a piece of Japan with incredible character and potential.

Japan's real estate market has finally shaken off its long-standing stagnation and is now in a phase of real growth. After years of being flat, a recovery is clearly underway, making this a very interesting time to get into the market.

The numbers back this up. Japan's total real estate market was valued at around USD 436 billion in 2024, and it's projected to climb to USD 557 billion by 2033. This isn't just on paper; it's reflected in rising land prices, which just saw their strongest gains since 1991. In fact, 64% of surveyed plots are now priced higher than they were in 2020. You can dig deeper into these Japanese real estate market trends to get a better sense of the current investment climate.

What Kind of House Can You Buy in Japan?

When you start browsing listings for houses in Japan, you'll quickly see it's a wonderfully diverse landscape. To find the right fit, you have to understand what life is really like in each type of home. Think of this as your field guide to the different kinds of properties you'll come across, helping you match your dream lifestyle with the perfect building.

The Japanese property market isn't a one-size-fits-all deal. It's a whole spectrum of choices, and each one offers a completely different way of life. Let's break down the most common options you'll encounter.

The Modern Detached House or 'Ikkodate'

When most people imagine a Japanese home, the 'ikkodate' (一戸建て) is probably what they picture. These are standalone, detached houses, a lot like single-family homes in Western countries. You'll find them everywhere in suburban areas, where they offer more space and privacy than a city apartment.

An ikkodate is perfect for families or anyone who wants a little garden, a parking space, and some room to breathe. The key benefit here is independence—no shared walls, and no building management fees to worry about.

The Urban Apartment or 'Mansion'

Don’t let the name throw you off; a 'mansion' (マンション) in Japan isn't a massive estate with a butler. It’s the common term for a modern, multi-unit apartment building, usually built from sturdy reinforced concrete. These are, by far, the most common type of housing in big cities like Tokyo and Osaka.

Living in a mansion is all about convenience. They often come with great security, shared facilities, and are almost always located a short walk from train stations and shops. If a central location and a low-maintenance lifestyle are at the top of your list, a mansion is your best bet. The trade-off? Less space and no private garden.

The Traditional Wooden Home or 'Kominka'

For anyone captivated by Japan's history and timeless aesthetic, the 'kominka' (古民家) is a truly special opportunity. These are traditional homes built with wood, often found in the countryside, that predate modern construction. Owning one isn’t just buying a house; it’s like becoming the caretaker of a piece of living history.

Kominka are all about natural materials, beautiful craftsmanship, and classic features like tatami mat rooms and sliding paper doors. They are incredibly charming, but they often need a lot of work to bring them up to modern standards for things like insulation and earthquake resistance. A kominka is less of a property and more of a passion project.

Choosing between these options really comes down to what you prioritize. Are you after the buzz of city life, the quiet space of a suburban home, or the unique character of a historical property? Your answer will point you in the right direction.

To help you visualize the trade-offs, here’s a quick comparison of the main property types.

Comparison of Japanese Property Types

This table breaks down the key features of common Japanese house types, helping you decide which one best aligns with your goals and budget.

| Property Type | Typical Price Range | Best For | Key Considerations |

|---|---|---|---|

| Ikkodate | ¥20M - ¥60M+ | Families, those wanting space and a garden | Maintenance is your responsibility; suburban locations often require a car. |

| Mansion | ¥30M - ¥100M+ | Singles, couples, professionals, urbanites | Monthly management fees; less space and no private outdoor area. |

| Kominka | ¥5M - ¥30M | DIY enthusiasts, history buffs, rural living seekers | Often require extensive, costly renovations; may lack modern amenities. |

| Akiya | ¥0 - ¥10M | Budget-conscious buyers, investors, project lovers | Condition varies wildly; hidden repair costs and legal complexities can arise. |

As you can see, each option has its own set of pros and cons. The "best" choice is entirely personal, depending on what you value most in a home.

The 'Akiya' Phenomenon: A Unique Opportunity

Beyond these main categories, there’s a special class of property you'll hear a lot about: 'akiya' (空き家), or vacant homes. This isn't a specific architectural style, but a status—a house that's been left unoccupied. Think of an akiya not just as an empty building, but as a blank canvas full of potential.

Due to Japan's demographic shifts, there's a huge "vacant house problem." The 2023 Housing and Land Survey revealed a staggering 9 million vacant homes, which is a national vacancy rate of 13.8%. Of those, around 3.85 million are effectively abandoned, creating a massive inventory of properties available at incredibly low prices.

These properties range from neglected ikkodate in the suburbs to forgotten kominka deep in the countryside. Taking on an akiya definitely requires careful research and a budget for renovations, but the reward can be a home bursting with character, bought for a tiny fraction of the usual market price. For a much deeper dive into the process, our guide on buying a house in Japan for a complete overview has you covered.

The Home Buying Process Step by Step

Buying a home in Japan can feel like a huge, complicated undertaking, especially if you're coming from abroad. But the truth is, the process is incredibly structured and logical. Forget the chaos you might imagine; think of it as a clear, well-marked path that takes you from the first property viewing right up to the moment you get the keys.

This guide will break it all down into simple, manageable steps. We'll walk through everything from finding the right agent to signing on the dotted line, so you can move forward with confidence and sidestep the common pitfalls.

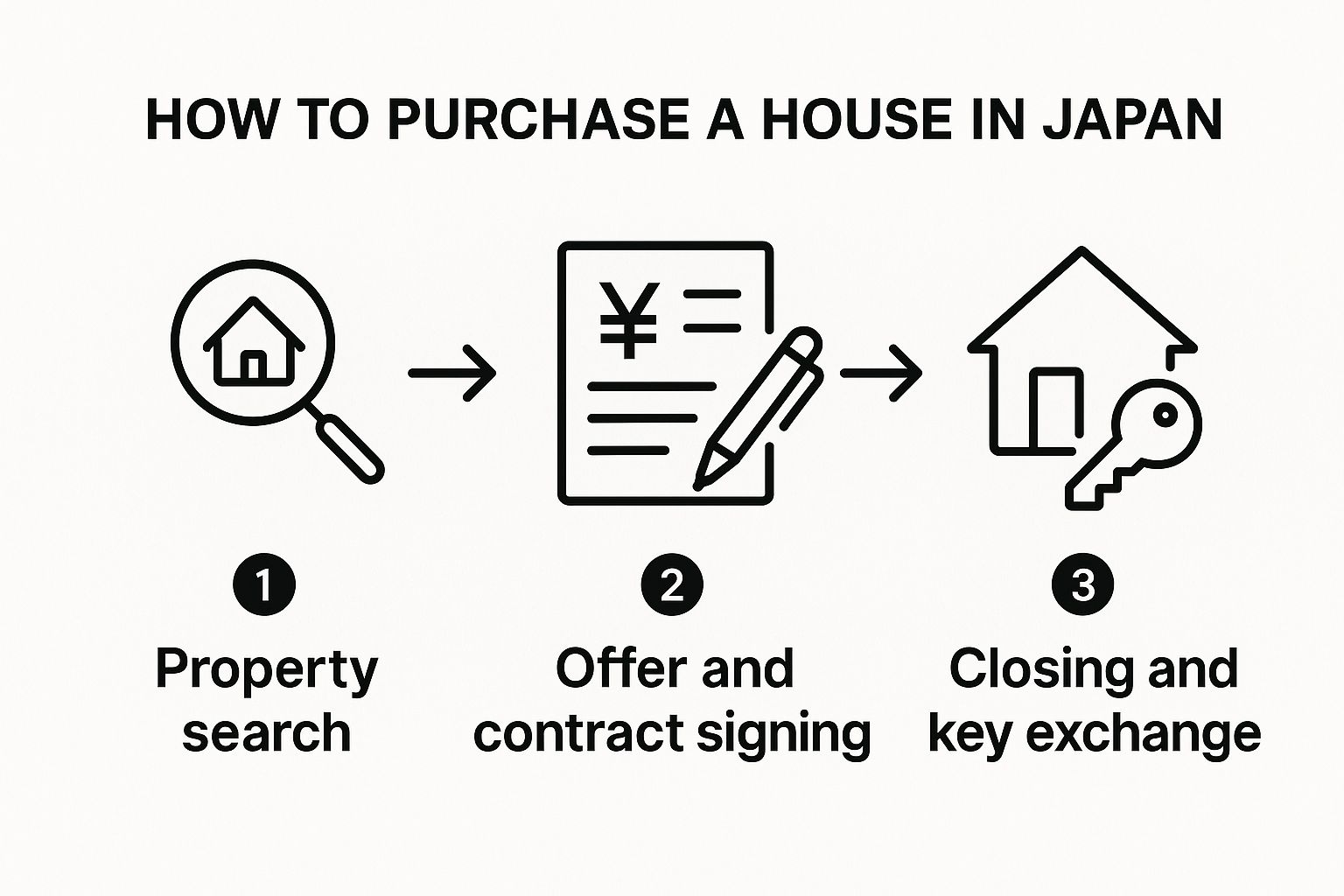

First, let's get a bird's-eye view of the journey.

As you can see, it’s a logical flow. Each stage builds on the last, ensuring every legal and financial detail is handled correctly before the property officially becomes yours.

Step 1: Finding Your Professional Team

Your first move—and arguably the most important—is to find a great real estate agent. In Japan, they're known as a 'fudousan-ya' (不動産屋). A good, bilingual agent is so much more than a property finder; they're your guide, negotiator, and cultural interpreter all in one.

Unlike in many Western countries where you might have separate lawyers and agents, in Japan, your agent handles much of the legal legwork. They are your first line of defense, responsible for everything from contract explanations to due diligence. This is why choosing the right one is absolutely critical.

Step 2: Making an Offer and Securing Finance

So, you’ve found the perfect place. What's next? You’ll submit a Letter of Intent (LOI). This isn't a legally binding contract, but it's a formal way of telling the seller, "I'm serious," and it kicks off the price negotiations.

At the same time, you need to have your finances lined up. If you're paying with cash, you're all set. But if you need a mortgage, you should have already been talking to a bank. Getting pre-approved for a loan doesn't just tell you what you can afford; it makes you a much more attractive buyer. Sellers love knowing the money is ready to go. For a deeper dive into financing, check out our guide on how to buy property in Japan.

Step 3: Due Diligence and Signing the Contract

Once the seller accepts your offer, things get serious. This is the due diligence stage. Your agent will present you with a crucial document called the "Explanation of Important Matters." It’s a comprehensive report that covers the nitty-gritty details of the property, including:

- Title Registration: Who legally owns the property.

- Property Description: The exact boundaries and any building restrictions.

- Zoning Laws: What you can (and can't) do with the land.

- Contract Cancellation Clauses: What happens if someone backs out.

Once you’ve reviewed everything and are happy to proceed, it’s time to sign the official purchase contract. This is when you'll pay the deposit, which is typically 5% to 10% of the purchase price.

A key difference in Japan is that the deposit is usually paid directly to the seller, not into a third-party escrow account. It's a practice built on a high-trust culture, serving as a powerful sign of commitment between both parties.

Step 4: The Final Settlement and Key Handover

The finish line! The final settlement usually happens at the buyer's bank. You, the seller, your agent, and a legal professional called a 'shiho shoshi' (司法書士), or judicial scrivener, will all be there. The scrivener's job is to make sure the ownership transfer is handled perfectly.

At this meeting, you’ll transfer the remaining balance to the seller. The shiho shoshi will immediately take the documents to the Legal Affairs Bureau to register you as the new owner. As soon as the seller confirms the funds have landed in their account, they hand over the keys. Just like that, the house is yours.

The whole process, from making an offer to holding the keys, usually takes about one to three months.

Getting to Grips with the Legal and Financial Side

The price you see on a listing for japan houses for sale is really just the starting point. Think of it like the price of a car—it’s the main figure, but it’s not the "drive-away" price. To get the full picture, you need to account for all the other costs that come with sealing the deal.

Budgeting accurately means looking beyond that big number. This part of the process can feel a bit daunting, but it doesn't have to be. We'll walk through every fee, tax, and legal step so you can plan with confidence and avoid any last-minute surprises.

Your Financial Checklist: More Than Just the House Price

When you buy a home here, you can generally expect the extra costs to add up to about 5% to 6% of the property's price. These fees aren't just fluff; they cover essential professional services and government taxes that make the purchase official.

Let’s break down the main costs you'll need to prepare for:

- Real Estate Agent Commission: This is for your agent’s hard work and expertise. It's calculated on a sliding scale, but for properties over ¥4 million, a standard formula is 3% of the purchase price + ¥60,000, plus a consumption tax on top of that.

- Stamp Duty: This is a tax you pay on the actual purchase contract. It's not a huge amount, but it varies with the property’s price, usually ranging from a few thousand to tens of thousands of yen.

- Registration and License Tax: This is the government's fee for officially registering you as the new owner of the land and building. It’s important to note this is calculated on the property’s assessed value, which is often lower than what you actually paid.

- Property Acquisition Tax: A few months after you’ve settled in (usually three to six), you'll get a bill for this one-time prefectural tax. The rate is typically 1.5% for land and 3% for residential buildings, again based on the property's official assessed value.

Here's a solid rule of thumb: set aside an extra 6% of the property's price. If you treat these closing costs as a non-negotiable part of your budget from the start, you'll have more than enough to cover everything without any stress.

The Legal Side: Foreign Ownership and Who You’ll Need

One of the first questions I always get from international buyers is, "Can I actually own property in Japan?" The answer is a clear and simple yes. Foreigners can own freehold land and buildings with no restrictions based on nationality or visa status. It's a surprisingly open and accessible system.

The whole transfer process is handled by a key legal professional called a 'shiho shoshi' (司法書士). You can think of them as a judicial scrivener or a specialized legal clerk. Their entire job is to make sure the property ownership moves from the seller to you, cleanly and legally.

The shiho shoshi will:

- Go through all the legal paperwork with a fine-tooth comb to ensure everything is legitimate.

- Prepare the official title transfer documents for the Legal Affairs Bureau.

- Formally register you as the new owner, making it official in the eyes of the government.

Essentially, the shiho shoshi is the gatekeeper of property ownership. They handle that final, critical step that cements your purchase, giving you the peace of mind that the title is clean and officially in your name.

Understanding the Long-Term Costs of Ownership

Of course, your expenses don't stop the moment you get the keys. Owning a home in Japan, like anywhere else, comes with annual taxes. Factoring these into your long-term budget is crucial for maintaining your property comfortably for years to come.

There are two main taxes to be aware of:

- Fixed Asset Tax (固定資産税, koteishisanzei): This is the standard annual property tax paid to the local municipality. The rate is typically 1.4% of the property’s assessed value as determined by the local government.

- City Planning Tax (都市計画税, toshi keikakuzei): This one only applies if your property is in a designated "city planning zone." The rate is usually around 0.3% of the property's assessed value.

You'll receive a bill for these from your local municipal office each year. By understanding both the upfront closing costs and these ongoing taxes, you get a complete and realistic financial picture of what it takes to own one of the many fantastic japan houses for sale.

Where to Find Japan Houses for Sale

Searching for Japan houses for sale can feel a bit like trying to navigate a sprawling city without a map. Japan’s property market isn’t a single entity; it’s a mosaic of very different regional markets, each with its own character, price tags, and way of life. Honestly, choosing where to buy is just as critical as choosing what to buy.

It's a lot like picking out a new car. You wouldn't get a two-seater sports car for family road trips, right? In the same way, your personal goals—whether you're an investor hunting for high returns or a family searching for a quiet escape—will naturally point you toward the perfect spot in Japan.

Kanto: The Urban Powerhouse

When most people picture Japan, they're probably picturing the Kanto region. It’s home to Tokyo and Yokohama, making it the undeniable economic and cultural heart of the nation. This is a place of constant energy, incredible convenience, and endless things to do.

Buying here means having world-class restaurants, shops, and one of the best public transit systems on the planet just outside your door. The trade-off? The price tag. Kanto is the most expensive market in Japan, but for serious long-term investors, it also holds strong potential for property value growth.

Kansai: Where Culture and Commerce Meet

Hop on a Shinkansen for a short ride, and you'll land in the Kansai region, which includes Osaka, Kyoto, and Kobe. Kansai offers a fantastic mix of bustling city life and deep cultural roots. Osaka is a powerhouse of commerce famous for its amazing food and friendly, outgoing locals, while Kyoto is the historic soul of Japan, brimming with ancient temples and peaceful gardens.

For property buyers, Kansai strikes a fascinating balance. It’s more affordable than Tokyo but still delivers the excitement and amenities of a major urban area. Investors are often drawn to Osaka for its solid rental yields, while people looking for a more traditional Japanese lifestyle often find their dream home in Kyoto’s quieter neighborhoods.

Fukuoka: Kyushu's Rising Star

Down on the southern island of Kyushu, Fukuoka is quickly making a name for itself as one of Japan's most livable and forward-thinking cities. It's got a youthful, energetic vibe with a booming startup scene, but it still maintains a relaxed atmosphere with easy access to both gorgeous beaches and green mountains.

Fukuoka’s property market is on the rise but is still much more affordable than Tokyo or Osaka. This makes it an exciting option for buyers who want city convenience without the sky-high prices. It's an ideal spot for digital nomads, young families, or anyone looking to get in on a city with a very bright future.

Hokkaido: The Great Northern Frontier

If you're someone who craves wide-open spaces and a real connection to nature, Hokkaido is your place. Japan's northernmost island is famous for its breathtaking landscapes, world-class ski resorts like Niseko, and incredible fresh food. Life here just moves at a different pace, guided by the seasons.

The property market in Hokkaido is incredibly diverse. You can find modern apartments in the city of Sapporo, or you could stumble upon charming farmhouses and rural retreats tucked away in the countryside. For those curious about unique fixer-uppers, our guide to abandoned houses for sale has some great tips, as many of these akiyas are found in rural places like Hokkaido. This region gives you the chance to buy a larger home with land for a fraction of what you’d pay on the main island.

The distribution of Japan’s housing market varies wildly, with Tokyo as the clear epicenter. The capital is home to about 37% of the country's population, and condominium prices there average around ¥110 million (roughly $800,000), with rental yields hovering near 3.4%.

But if you look elsewhere, you can often find more attractive returns. For example, rental yields are higher in Osaka at about 4.5% and can climb to around 5% in Sapporo. Digging into the nuances of the Japanese real estate market really helps to see how these regions stack up.

Choosing a region is about aligning your search with your vision. An investor might analyze spreadsheets and find their answer in Osaka’s rental yields, while a family might find theirs by picturing winter mornings in a cozy Hokkaido home.

Each of these regions offers a completely different slice of Japan. By understanding what makes them tick, you can narrow your search and get one step closer to finding the perfect home for you.

Common Questions About Buying a House in Japan

Stepping into the Japanese real estate market for the first time? You've probably got a lot of questions. We get it. To help clear things up, we've put together answers to the most common queries we hear from buyers just like you.

Think of this as your go-to guide for those nagging details. Let's get these questions answered so you can move forward with confidence.

Can a Foreigner Actually Buy Property in Japan?

This is easily the most common question, and the answer is a simple, straightforward yes. Japan is incredibly welcoming to international buyers. You don’t need citizenship, a permanent resident visa, or even to be living in the country to purchase freehold land and property.

The legal steps for buying a home are exactly the same for Japanese citizens and foreigners. It’s a level playing field, which is a big reason why Japan is so appealing to global investors who want a secure and uncomplicated process.

In Japan, property ownership rights are not tied to your visa status or nationality. This simple but powerful policy removes a massive barrier that exists in many other countries, making the dream of owning a home here accessible to everyone.

What Paperwork Will I Need?

You might be surprised by how little paperwork is involved, especially if you're a cash buyer living outside of Japan. While the exact list can shift slightly, the core documents are pretty basic.

- Living outside Japan? You'll generally just need your passport and an affidavit. An affidavit is simply a sworn statement you sign in front of a notary in your home country to confirm who you are and where you live.

- Living in Japan? You'll need your passport, your Residence Card (Zairyu Card), and maybe an inkan (a personal seal), although a simple signature is usually fine for foreigners.

If you’re applying for a mortgage, the bank will naturally need more, like proof of income from the last few years. It's always a good idea to double-check the final list with your real estate agent and your bank.

How Hard Is It for a Foreigner to Get a Mortgage?

This is where things can get a bit tricky. Securing a mortgage is definitely more challenging for foreigners than for Japanese nationals, but it’s far from impossible. It all comes down to meeting the bank’s criteria, which usually revolves around your ties to Japan.

Having permanent residency (PR) is the golden ticket; Japanese banks are much more likely to approve your loan. If you don't have PR, lenders will look for other strong connections, like being married to a Japanese citizen or holding a stable, long-term work visa with a well-known company.

For non-residents without those connections, getting a loan from a Japanese bank is extremely difficult. Most buyers in this situation either arrange financing from a bank in their home country or buy the property with cash.

What Are the Biggest Hidden Costs I Should Know About?

The asking price is just the beginning. It's absolutely crucial to budget for closing costs, which are the standard fees and taxes needed to finalize the deal.

A good rule of thumb is to set aside an extra 5% to 6% of the property's purchase price. This will cover everything that comes up. These costs typically include:

- Agent Commission: Usually 3% of the price plus ¥60,000.

- Registration and Stamp Taxes: Government fees for officially recording the sale.

- Property Acquisition Tax: A one-time tax that you'll be billed for a few months after you buy.

- Judicial Scrivener Fees: This is for the legal expert who handles the official title transfer.

Budgeting for these costs from the start means no nasty surprises on closing day. It’s a critical step when you're browsing those listings for Japan houses for sale.

Ready to turn that dream into a plan? With mapdomo, you can explore over 100,000 listings across Japan, from sleek Tokyo apartments to quiet countryside akiyas. Our interactive maps and smart filters help you pinpoint the perfect home. Start your search on mapdomo.com and discover your new life in Japan.